Joan Laporta is not one to mince his words. The FC Barcelona president claimed in June that the club had been “clinically dead” when he took over in March last year, but had now been moved to intensive care following an emergency financial intervention .

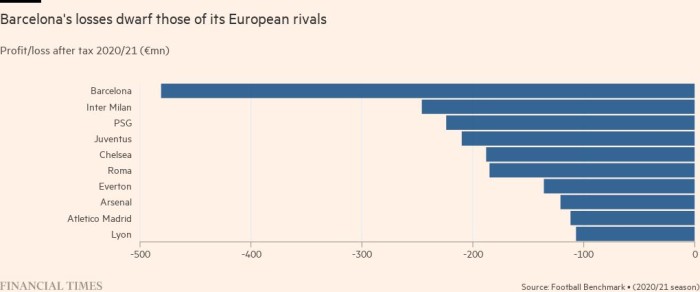

His goal was to convince those in front of him—an audience of club owners—to approve measures to repair his battered balance sheet and allow him to “lead a normal life” again. Barcelona had just recorded a loss of nearly 500 million euros after the 2020/21 season, a record for any football club.

With the blessing of the partners, who vote on key decisions, Laporta has since sold more than €600m of assets, with more on the way.

But the expectations of a new Barcelona built on frugality and young players have had little time. This summer, more than €150 million has already been spent on signings, the biggest in Europe, including the third most expensive transfer ever for a footballer over 30. The club is still in the market for more players, although it is still unable to sign any due to the financial rules of the Spanish league.

The question is whether this spending will allow him to recapture past glories on the field or store up more financial problems for the future.

Troubled years

Almost a year ago, Lionel Messi bid a tearful farewell to FC Barcelona. The Argentine superstar had joined as a child but became the most prominent victim of the financial problems that hit the club. It was also a major factor in these problems. According to a leaked contract published in Spanish newspaper El Mundo, Messi earned more than 555 million euros between 2017 and 2021.

The club’s financial problems accumulated little by little, and suddenly they have accelerated.

You are viewing a snapshot of an interactive chart. This is likely because you are offline or because JavaScript is disabled in your browser.

There were years of high spending on players with disappointing results on the field. Between 2017 and 2021, the club spent more than €1 billion on signings, according to figures from football site Transfermarkt, resulting in a net transfer loss of €340 million. It also had the highest annual wage bill in Europe, peaking at €575 million in 2019, €180 million more than arch-rivals Real Madrid.

Revenues are expected to top €1 billion in 2019/20, but then the pandemic hit and the club was forced to close its 99,000-seater stadium.

By the 2020/21 season, the debt had risen to €1.35 billion according to Laporta. The aborted attempt by 12 of Europe’s biggest soccer teams, including Barcelona, to create a breakaway super league with a hefty sign-on bonus dashed hopes of a quick financial fix.

With pronounced losses and strict financial rules imposed by the League – which calculates an annual budget for each club to spend on players, based on their income and costs -, Barcelona had no choice but to let Messi go, while the other players were asked to collect the salary. wage cuts and deferrals in an effort to reduce the bill.

The club’s fortunes on the grass also suffered. They finished third in the Spanish league in the 2020/21 season, their worst performance in more than a decade and have not won Europe’s top club competition, the Champions League, since 2015. Since then, Real Madrid have won four times. Barcelona were also knocked out of the 20/21 Champions League in the second round in a humiliating 4-1 defeat at home to Paris Saint-Germain, where Messi went when he left.

Problems on the pitch happened in the boardroom. Then-president Josep Maria Bartomeu resigned before a no-confidence vote, before its members voted to reinstate Laporta, who had presided over Barcelona during a more successful period between 2003 and 2010.

Repair attempt

New management took over a cash-strapped club struggling to pay wages. Drastic action was needed. Goldman Sachs, the club’s long-time bankers, acted quickly to restructure nearly 600 million euros of debt. Under the terms of its 10-year bond deal, Barcelona agreed to pay a group of American investors just under 2% interest, a sign of a strong appetite to lend to the club.

You are viewing a snapshot of an interactive chart. This is likely because you are offline or because JavaScript is disabled in your browser.

Then, they thought of generating more income. Officials scheduled a series of membership meetings to allow for regular votes on plans to rebuild the balance sheet. A new partnership with Spotify was sealed earlier this year, giving the streaming service shirt sponsorship and naming rights to the Camp Nou stadium, which is due for a major renovation.

In June, members approved a series of asset sales. A month later, American investment firm Sixth Street had agreed to buy 25 percent of the League’s broadcast rights over 25 years for just over €500 million, in a deal brokered by Key Capital, a boutique investment firm with close ties to Real Madrid.

At face value, Sixth Street appears to be buying future earnings at a discount. A simple calculation suggests that the 25% share of the rights has been sold for around 21 million euros per year. In 2020/21, a quarter of Barcelona’s League rights were worth just over 40 million euros per year.

Some worry that the deal will be a one-time patch to ongoing problems. “My concern right now is that they are using these long-term assets to invest in this [transfer] window, and that’s not smart,” said a person closely linked to the club’s management.

However, both sides reject the comparison. Instead, they say the deal is more like a strategic partnership — it’s structured like a joint venture — and that Sixth Street, which also has a big international events business, will help Barcelona boost its revenue in long term.

Lionel Messi cried during his farewell press conference in Barcelona in August 2021 © Albert Gea/Reuters

Lionel Messi cried during his farewell press conference in Barcelona in August 2021 © Albert Gea/Reuters

This week, the club said it had also agreed to sell a 25 percent stake in Barca Studios, its video and audio platform, for 100 million euros to crypto business Socios. A share of up to 49 percent of the club’s merchandising business is also up for sale.

Andrea Sartori, chief executive of consultancy Football Benchmark, said the club’s finances were so bad last year that selling the broadcast rights was essential.

“They didn’t have much of an alternative, what else could they have done in a very bad situation? Yes, they sold the family jewels, but it was probably the only thing they could do,” he said. “Hopefully they can win on the field for be able to generate additional income in the coming years. If not, in three to five years we could see new problems at the club.”

Summer expenses

While money has flowed in from asset sales, much of it appears to be flowing straight back out. Last month, Barcelona signed Brazilian winger Raphinha from Leeds and Polish striker Robert Lewandowski from Bayern Munich for a total of around €100 million. On Monday, he beat Chelsea to Sevilla’s Jules Koundé in another €50m deal. Two more players have been signed on free transfers, while others are expected to join before the September 1 deadline.

All this has happened as the club continue to try to negotiate pay cuts for existing players.

The signing of Lewandowski on a four-year contract has particularly woken up the old ladies as he will turn 34 this month. Only Cristiano Ronaldo has commanded a bigger fee for a player of that age.

Asked about the transfer, Bayern coach Julian Nagelsmann said: “It’s the only club in the world that doesn’t have money, but [can] buy all players It’s a little strange and a little crazy for me, but in the end they find solutions.”

None of the new players have yet been registered in the Spanish league. That is likely to happen later in the summer once the club have sold some of their existing squad to meet League rules on spending on players. However, player sales have been complicated by deferred wage deals.

Raphinha during a friendly between Inter Miami and Barcelona last month © Chandan Khanna/AFP/Getty Images

Raphinha during a friendly between Inter Miami and Barcelona last month © Chandan Khanna/AFP/Getty Images

The club say the signings are part of a “virtuous cycle strategy” in which better players lead to better results, and better results help generate more revenue. “What our supporters want is to have the best players in the world and to win,” said a Barça official.

Others say it is politics rather than economics that requires the club to continue spending because the club president is elected by the members.

“In Barcelona, if you are the president and you are not from a sporting point of view, the pressure is massive”, said the person closely linked to the club’s management.

Lesson for the future

Although the club has received an injection of cash, there are still issues that need to be managed. Next summer he will start paying the principal on his bond after a two-year vacation. Meanwhile, he will no longer receive 100 percent of the revenue from broadcast matches.

The Camp Nou redevelopment is expected to cost up to €1.5 billion, although Goldman has already arranged the financing and the costs will not have an impact on the club’s balance sheet.

Not all the new cash has gone to the staff: a part of 125 million euros of debt has already been paid.

This year’s team has a handful of young players, some from Barcelona’s academy, a sign that the club is mixing big-name signings with local talent. Pedri, 19, was signed by Barcelona from Las Palmas in 2020 for just 5 million euros; he is now the fourth most valuable player in the world, with more than 135 million euros, according to the CIES Football Observatory.

The club are also signing other players seen as valuable assets – some are wanted by Premier League rivals – and have introduced a new wage structure to keep the wage bill under control.

“We have learned our lesson. . . We are not trying to repeat the same mistakes,” said the club official. “It’s like a big ship. You have to move in the right direction, and then it starts to accelerate.”

Still, ratings agency Fitch cut its outlook for the club on Friday, citing poor financial performance last season, lower-than-expected debt reduction and the potential impact on ticket sales a once construction work on the stadium begins.

However, a person with deep knowledge of the club’s finances said that the broadcast rights that have been sold amount to less than 5 percent of Barcelona’s total income and that this income could be recovered quickly if the performance on the pitch improves or the value of the rights themselves is reduced. up

“They have to act . . . but they have a lot of leeway,” the person said. “I think people are making a lot of noise about nothing.”

[ad_2]

Source link