Justin Sullivan

Thesis

In the June quarter Warren Buffett bought one $3 billion stake in Citigroup (NYSE: C). And investors shouldn’t be surprised: Citi trades with deep multiples and its valuation materially lags its peers. For reference, with a P/B of x0.55 and a non-GAAP PE of x6.46 Citi is valued with an industry discount between 30% and 50%.

I recognize that since the financial crisis, Citigroup has significantly underperformed the market and industry peers. This is likely one reason why sentiment is lagging bank fundamentals. Or in Buffett’s way of thinking: Investors are still fearful when in reality they should be greedy.

Looking for Alpha

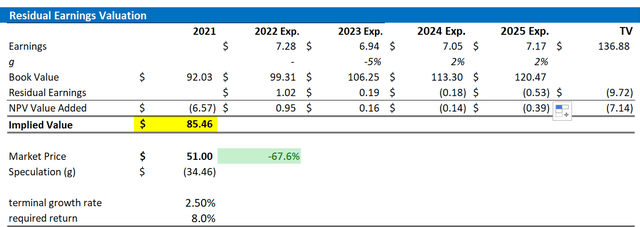

Personally, I think Citi should trade near x1 P/B. This estimate would be consistent with my price target of $85.46/share that I derived from a residual earnings valuation.

About Citi

Citigroup is a highly diversified financial services company and the fourth largest bank in the US. The company has approximately 200 million customer accounts worldwide and a total balance sheet size of $2.381 trillion (June 30, 2022). Operating in more than 160 countries, Citi has long been considered the “most global” bank. As of 2021, Citigroup has been ranked number 33 on the Forbes 500 list.

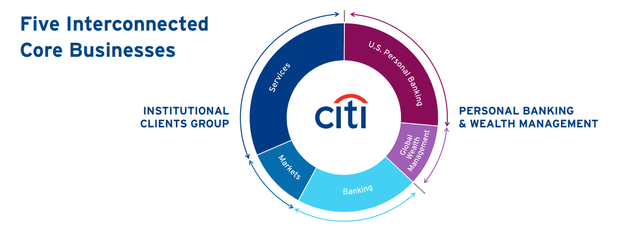

Citi operates multiple banking franchises: As a percentage of revenue, the institutional client group is the largest segment, accounting for about 30% of total sales, followed by US personal banking at 25%, banking with 20% and the management of global assets and global markets. with 8-10% each.

Introducing Citi Investor

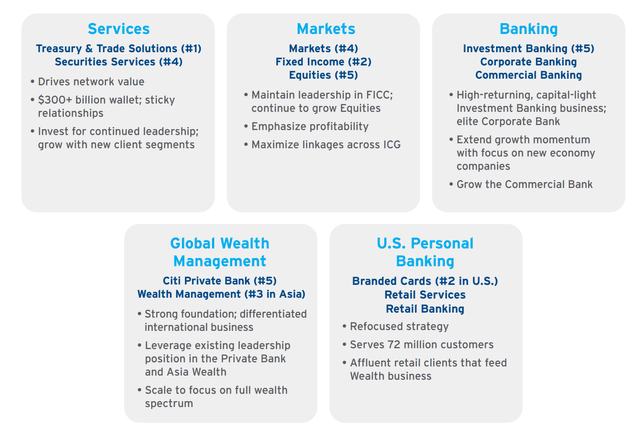

Above all, Citi is a leading player in all segments, with No. 1 in Treasury and Trading solutions, No. 3 in Wealth Management in Asia and a competitive position in Investment Banking and Global Markets.

Introducing Citi Investor

I think the strength of Citi’s highly diversified portfolio is very important as it protects the bank from economic downturns and market turbulence to some extent. For example, consider the recent past: In an environment of near-zero interest rates and stable markets, Citi’s investment banking and wealth management franchise are doing well. In a stressed market, Citi’s Global Markets division is poised to benefit. And rising interest rates favor higher retail banking revenues.

To support Citi’s fundamental appeal, consider quarter of June 2022, which was pressured by a weak macro economy (negative GDP growth). From April through the end of June, Citi generated $19.6 billion in revenue and posted $4.5 billion in net income. In particular, almost all business segments grew by double digits year-over-year, except for global wealth management which remained flat.

Introducing Citi Investor

Very attractive rating

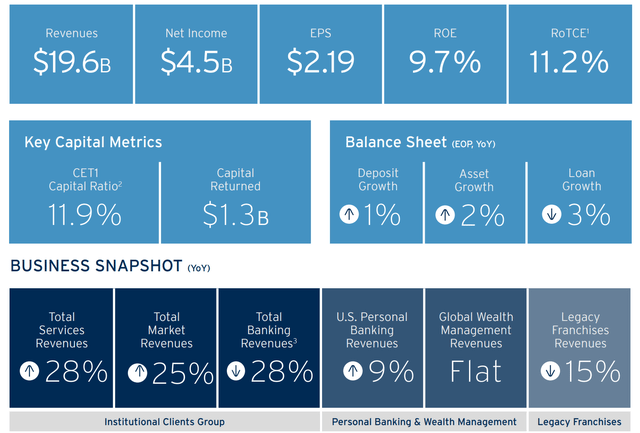

Citi stock is very cheap compared to US banking companies. For reference, Citi trades at a P/E of x7, P/S of x0.8 and P/B of x0.55, while JPM trades at a P/E of approximately x10, P/S of about x2.5 and P/B of almost x1.5. So it’s fair to say that JPM is almost twice as expensive as Citi.

While I think JPM is fairly valued at x1.5 P/B (a premium to the industry leader is warranted), I consider Citi to be strongly undervalued. According to Goldman Sachs research, the cyclical low for banking stocks is around the x1 P/B multiple and the historical average is around x1.5. That said, Citi currently trades at about half the P/B multiple that investors would expect in a cyclical downturn.

Goldman Sachs Research

Valuation of residual earnings

In my view, banks are prime candidates to be valued with a residual earnings (“RE”) valuation, given that the RE framework is based on both the income statement and the balance sheet, as well as accounting for accrual Having said that, I apply the following assumptions:

To forecast EPS, I look to consensus analyst forecasts available in the Bloomberg terminal through 2023. In my view, any estimate beyond 2023 is too speculative to include in a valuation framework, especially for banks. To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the 10-year US Treasury yield as of August 1, 2022. My calculation indicates a fair required return of about 10%. To get Citi’s tax rate, I extrapolate the 3-year average effective tax rate of 2019, 2020, and 2021. For the terminal growth rate, I apply 2% percentage points, lower than the 3% nominal GDP growth I believe which is a fair assumption for an industry leader.

Based on the above assumptions, my calculation returns a base case target price for Citi of $85.46/share, implying a material upside of nearly 70%.

Analyst Consensus Estimates; Author’s calculation

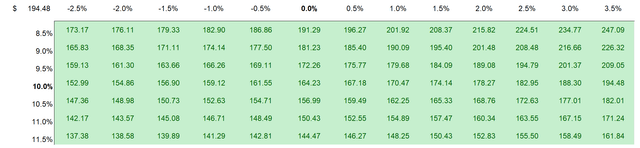

I understand that investors may have different assumptions regarding Citi’s required performance and terminal business growth. Therefore, I also attach a sensitivity table to test different assumptions. For reference, red cells imply overvaluation compared to the current market price, and green cells imply undervaluation.

Analyst Consensus Estimates; Author’s calculation

risks

While I believe investments in banks are less risky than the market implies, the exposure to ultimate risk is still high, and if it materializes, this could significantly depreciate Citi’s share price. For reference, take the Great Financial Crisis as an example, which crippled many bank stocks for several years, if not decades. Anyway, CET1 of 11.2% of Citi The ratio should cushion the company for most market stress scenarios. Jane Fraser, Citi’s CEO said:

These results (FED stress test) demonstrate again that Citi has the capital to withstand a severe economic downturn. We have the ability to maintain the current common dividend of $0.51 per share under a range of stress scenarios

conclusion

Given a deeply depressed valuation combined with attractive fundamentals, I like Citi’s risk/reward. In my view, market sentiment is lagging the bank’s potential. When I value the bank based on a residual earnings model, I see about 70% upside. My target price is $85.46/share.

My other articles on US banks:

JPMorgan Chase: The industry leader is too cheap to ignore

[ad_2]

Source link