Chunumunu

Quick Start with Business Development Companies (“BDCs”)

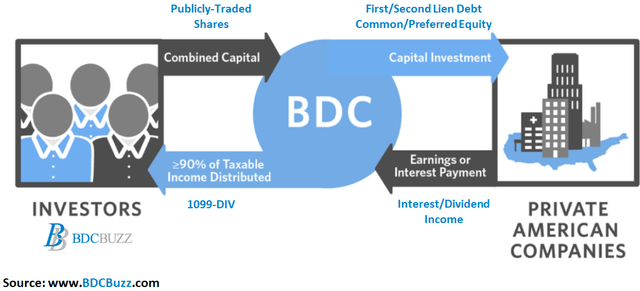

Business Development Companies (“BDCs”) invest shareholder capital in privately held, small and mid-sized US companies. BDCs aim to generate income and capital gains when the businesses in which they invest, such as venture capital or private equity, are sold. background Anyone can invest in BDCs, as they are public companies listed on major stock exchanges.

BDC Buzz

Investment Grade BDC Bonds/Notes

Many BDCs have them investment grade Bonds/notes (“IG”) for lower risk investors who don’t mind lower returns/yields. Thanks to the recent declines in fixed income, the traditional bond market now offers excellent value, especially in the BDC sector, and I’ll be talking about that in the coming weeks. Now, many of these bonds are rallying and I’ve started buying with medium maturities, which for me is between 3 and 6 years.

Traditional bonds are not traded on stock exchanges, but are available through your brokerage using CUSIP numbers with a face value/maturity of $1,000. These bonds pay interest semi-annually with a prorated interest payment on the date of purchase. Brokerages express trading prices as a percentage of face value.

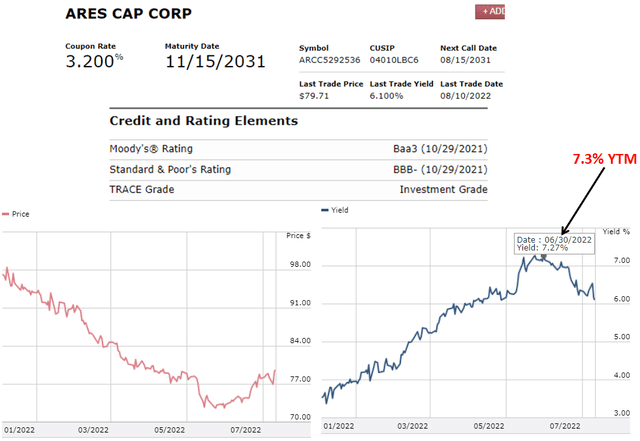

As discussed below, ARCC’s 2031 bond has a current price of $79.71, implying a present value of $797.10 for each bond. For more information on examples of how to trade bonds with CUSIP and limit orders, see the link below.

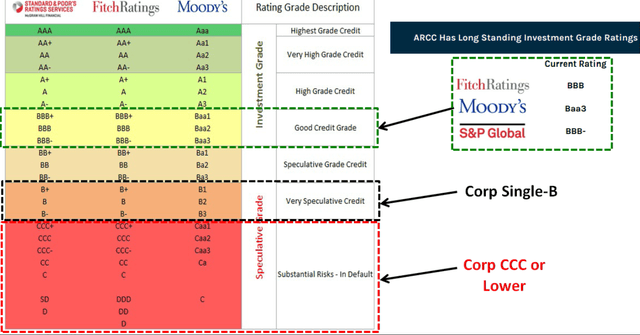

Most BDC bonds have credit ratings from Moody’s and/or S&P, and to date no BDC has ever defaulted for the reasons discussed last week in:

Recession-proof with investment grade bonds

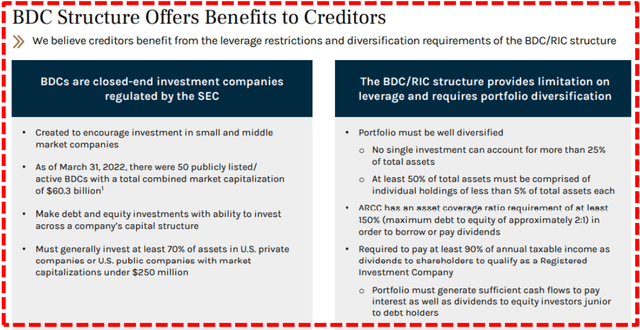

As shown below, BDCs are highly regulated with many protections for investors in common stock and debt obligations, such as the amount of leverage (asset coverage ratios are discussed later), asset diversification and having a portfolio that can “generate sufficient cash flows.” to pay interest and dividends to equity investors less than debt holders”:

ARC

ARC

Ares Capital investment grade bonds

Capital of Ares (NASDAQ: ARCC) It has 9 bonds of investment (cuspes: 04010lau7, 04010lax1, 04010LAV5, 04010lay9, 04010laz6, 040LBA0, 04010LBD4, 040LBB1, 04010LBB18, 04010LBA0, 040LBD4, 04018, 040LBB18, 040LBB18, 040LBB18, 040LBB18, 040LBB18, 040LBB18)

Credit agencies

As discussed in the article linked above, the “Asset Coverage Ratio” is a financial metric that measures how well a company can pay its debts by selling or liquidating its assets. The higher the asset coverage ratio, the more times a company can cover its debt. Therefore, a company with a high asset coverage ratio is considered less risky than a company with a low asset coverage ratio. BDCs are required to maintain a minimum asset coverage of 150%, providing strong protection for bondholders, which is one reason why no publicly traded BDCs have ever filed for bankruptcy or defaulted of bondholders in the history of the sector.

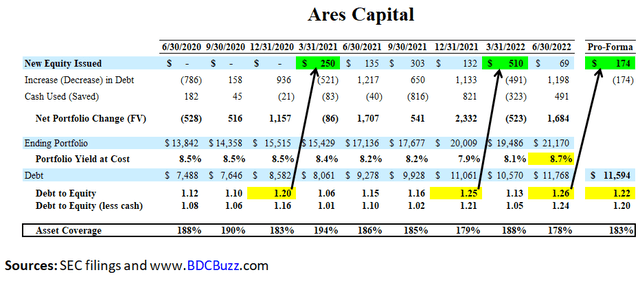

As of June 30, 2022, ARCC’s asset coverage ratio was 178%. However, on August 2, 2022, ARCC issued 9,200,000 shares at a price of $19.00 per share, generating net proceeds of approximately $174.4 million, after deducting discounts and commissions and estimated offering expenses.

As shown below, the The pro forma asset coverage ratio would approach 183% but of course it doesn’t account for other changes such as portfolio growth or exits.

BDC Buzz

The “Interest Expense Coverage” ratio is used to see how well a company can pay the interest on outstanding debt. Also called the time-interest earned ratio, this ratio is used by creditors and potential lenders to assess the riskiness of lending capital to a company. A higher coverage ratio is better, although the ideal ratio can vary by industry. When a company’s interest coverage ratio is only 1.5 times or less, its ability to meet interest expenses may be questionable.

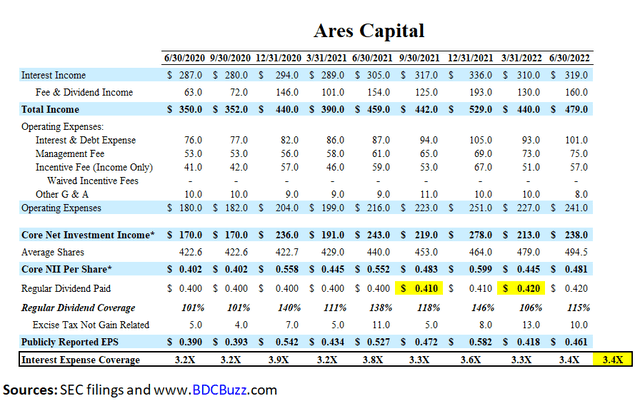

Historically, ARCC’s interest expense coverage ratio has averaged around 3.4 times, as shown below:

BDC Buzz

BDC interest rate sensitivity drives dividend increase

As predicted in previous articles, many BDCs have announced dividend increases in recent weeks partially related to rising interest rates. My article last month “Fixed 6.5% Return On Main Street Investment Grade Bond” mentioned the following:

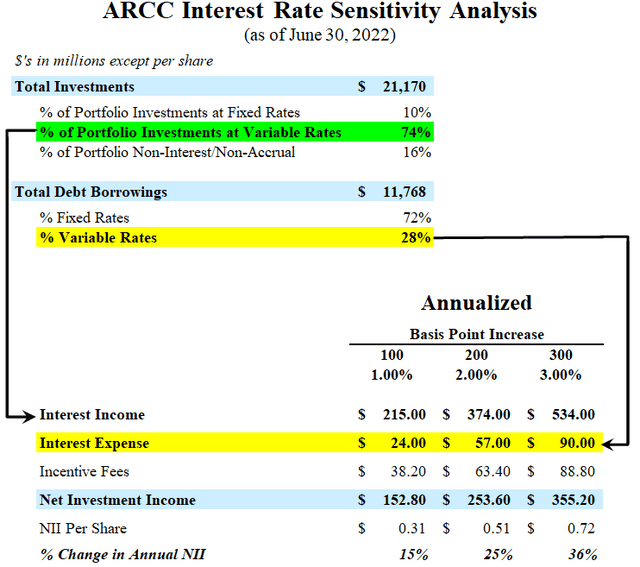

There’s a good chance that many BDCs will increase dividends in the coming quarters, especially since the Fed is likely to raise rates by another 75 basis points today. [July 27, 2022]resulting in a significant improvement in this analysis for most BDCs

Interest rate sensitivity refers to the change in earnings that may result from changes in interest rates. As of June 30, 2022, 74% of ARCC’s portfolio investments were variable-rate, 10% fixed-rate, 16% non-interest-bearing or in non-accrual status. The Revolving Credit Line, the Revolving Financing Line, the SMBC Financing Line and the BNP Financing Line carry interest at variable rates with no interest rate limits. The 2024 unsecured notes and convertible notes bear interest at a fixed rate.

Based on our estimates of earnings growth from higher interest rates coupled with the strength of our investment portfolio, we have increased our regular quarterly dividend to $0.43 per share. Our balance sheet remains a notable source of strength with ample liquidity, moderate leverage and more than 70% of our outstanding debt derived from long-term, fixed-rate unsecured notes. Market rate increases in the second quarter have not yet fully flowed through our earnings. We estimate that our second quarter earnings would have been approximately $0.05 per share higher if the market rate increase in the second quarter had been in effect throughout the quarter. We believe we are well positioned for our earnings to benefit from further increases in short-term market interest rates.

BDC Buzz

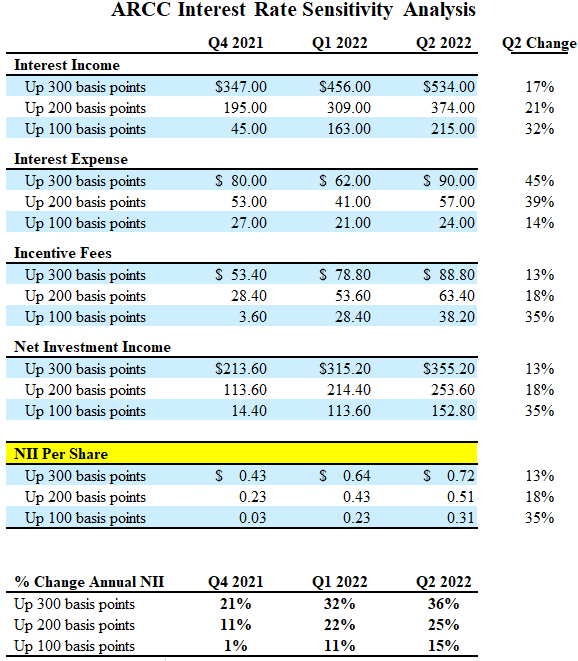

The table below shows the change from 4Q 2021 to 2Q 2022 with the impact of a 100 basis point increase changing from an additional $0.03 per share of annual earnings (as of December 31, 2021) to $0.31 per share (as of June 30, 2022). ).

“We do not believe that a tightening monetary cycle will have a negative effect on us. Our heavy floating rate loan portfolio is primarily funded by unsecured fixed rate funding sources and our assets are largely floating rate investments. We believe that this positions us well for our net interest earnings to benefit from rising rates.”

BDC Buzz

Current yields for stocks and bonds

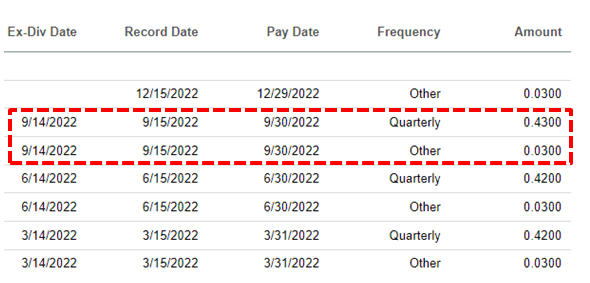

My previous projections for ARCC predicted a regular quarterly increase to $0.43 per share by the third quarter of 2022, and I expect another dividend increase by the fourth quarter of 2022, partially related to higher interest rates high, but also with portfolio growth and/or additional income from Ivy Hill Asset. Management (“IHAM”) partially due to the previously announced acquisition of the direct loan portfolio of Annaly Capital Management (NLY):

We just did a really big transaction there, obviously buying that wallet from Annaly. They took on over $1 billion in assets. We made a substantial investment in the company which is a bit of a needle mover for this quarter relative to others. In this quarter, we actually had a one-time dividend that wasn’t necessarily expected from an equity investment in a portfolio company. But then the lion’s share of the increase, as you can probably expect, is our continued investment in Ivy Hill, that’s bigger, it’s just going to pay us a bigger dividend going forward.

ARCC previously announced $0.12 per share of “additional dividends” paid evenly each quarter for a total of $0.46 per share for the third quarter of 2022:

Looking for Alpha

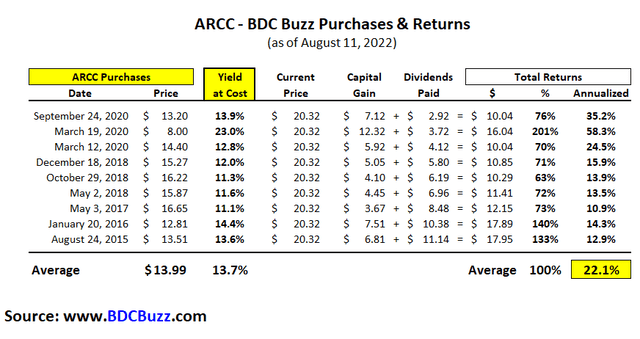

The “Annualized” statement shown below is shown the actual composition of the annual returns. This is the true return each year, which has averaged almost 22% over the last 9 purchases. even after taking into account the recent market pullback.

BDC Buzz

ARCC bonds maturing between 2026 and 2031 (between 4 and 9 years) were trading around 20% below par, but have started to recover. For example, their 2031 bond was trading below 73 on June 30, 2022 and is now almost 80, but still yields over 6%. It’s important to note that that’s almost a 10% gain (from 73 to 80) in just the last 6 weeks, and you’re still getting a yield to maturity of over 6% for new purchases:

FINRA

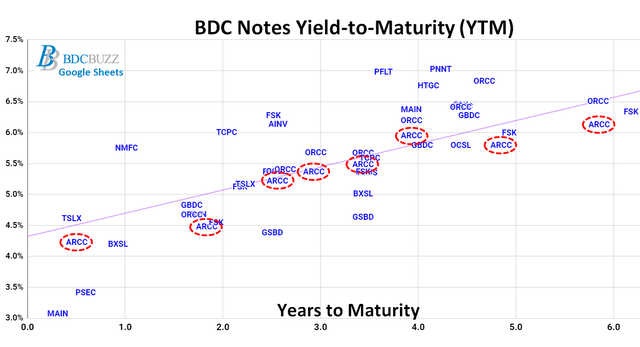

The following chart is from the Google BDC Spreadsheets showing ARCC bonds and I will continue to cover many other BDCs listed below, including their asset coverage and interest expense ratios.

It is interesting to note that many of ARCC’s bonds currently have relatively lower yields for similar maturities, but this is likely related to higher quality and higher trading volumes/liquidity.

Google BDC Spreadsheets

Conclusion – Risk-adjusted returns

Given the uncertainty of future returns on equity/equity positions, I suggest that investors take advantage of this opportunity to achieve the 6% yield provided by the investment grade notes. ARCC is a higher quality company and investors can use a “bar approach” by investing a portion in common stock as well as investment grade bonds.

The key risk to the bondholder is a default by ARCC, which is extremely remote given the company’s track record/performance:

ARCC is one of the best BDCs with a long track record of returns through previous market cycles. Debt asset coverage is 183% and by regulation must be at least 150% Interest expense coverage has averaged about 3.4 times, which is a lot. higher than most companies. ARCC’s bonds are rated investment grade by S&P, Moody’s and Fitch. No publicly traded BDC has ever filed for bankruptcy and impaired debt holders in the history of the industry. for an average of 7.5%

[ad_2]

Source link