Daleta

Last week saw the S&P 500 (SP500, SPX) posted its first weekly loss in about a month. The culmination of a VIX expiration, Fed minutes and monthly options expiration helped break the stock market on Friday and potentially the summer concentration ended dead in his tracks.

Maybe now when things get interesting, with Jackson Hole this week and a bunch of Fed officials pushing back against the markets, concluding with Jay Powell himself on Friday, August 26th.

Anchored in reality

While equity markets have been focused in fantasyland on a make-believe Fed pivot, bond and currency markets have been anchored in reality. This reality shows that there is no pivot, and those who bet that a pivot will come will be proven wrong.

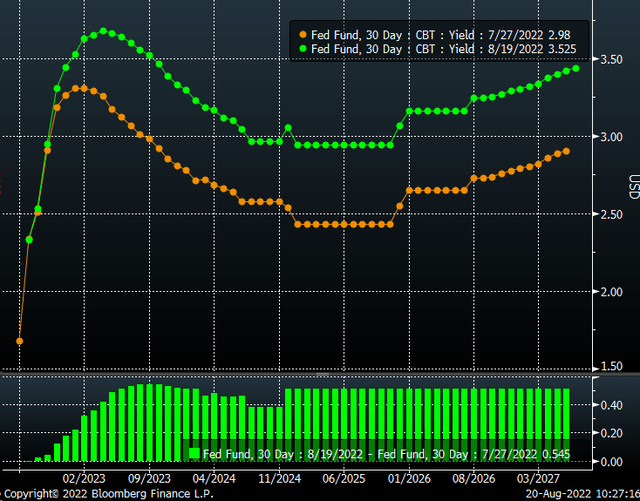

Fed Fund Futures show us that rates have risen significantly since the July FOMC meeting, with two more full rate hikes from May 2023 through early 2024. Also, the top rate has been changed from January 2023 to April. . Fed funds futures are now making more rate hikes and staying higher for longer.

Bloomberg

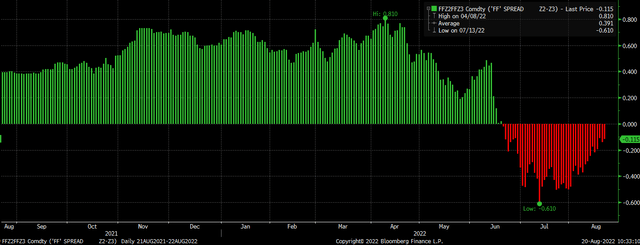

Not only that, but the spread between the December 2022 and December 2023 Fed Funds contracts has narrowed to just -11bp, from more than -40bp in July. This is a massive change in a short period, indicating that the market is setting fewer rate cuts in 2023.

Bloomberg

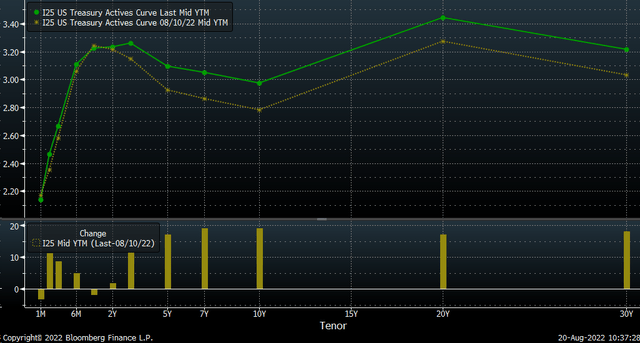

Even nominal yields appear to be in line and have risen sharply since the weaker than expected CPI and PPI reports. Instead of lowering rates, they have increased. Look at the yield curve, with rates rising 15-20bps from the 5-year Treasury to the 30-year Treasury. Meanwhile, 2-year rates have remained unchanged. If the market saw a dovish turn or that inflation would suddenly crash, then rates would have to come down, not up.

Bloomberg

Even the dollar index has risen significantly. After initially falling following the CPI report, the dollar index has broken out, breaking out of a critical downtrend. It’s up almost 4% since August 11 and almost 1.5% since the July 27 lows. The dollar has been rising as it sees more brutal monetary policy and had a massive move higher after the Fed’s August 17 minutes.

TradingView

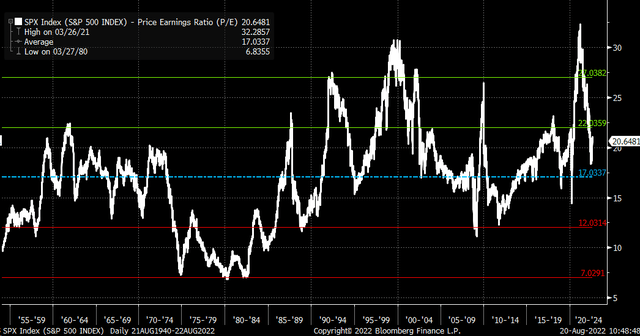

Disengaged

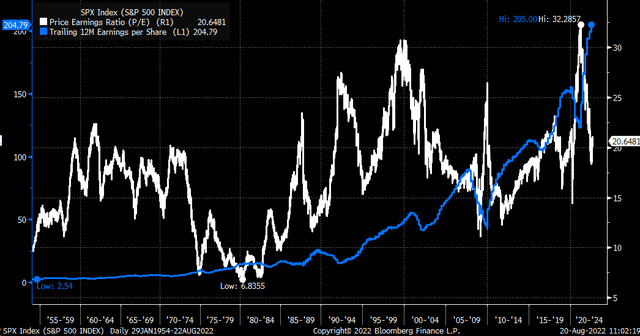

Meanwhile, since July 14, the S&P 500 is up 13.6% through August 19 and up 15.7% from its August 16 peak. This has pushed the S&P 500 PE ratio on a trailing twelve month basis to 20.6. This is more than 3 points higher than its historical average dating back to 1954 of 17. The most striking feature may be that in the 1970s and early 1980s, the last time inflation was so high, the PE ratio was below. 10. The big difference between now and then was that rates were much higher in the 1970s and 1980s.

Bloomberg

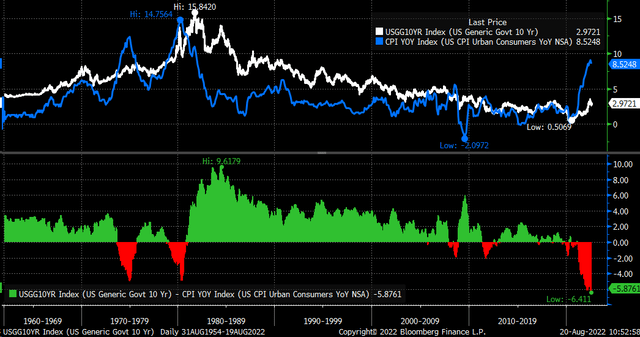

The high inflation rates of the 1970s and 1980s pushed the nominal 10-year rate to around 16% at its peak in 1981. Meanwhile, the spread or difference between the 10-year rate and the annual rate of l ‘IPC was positive. At the moment, this spread is deeply negative at over 6%. The only other two times in recent history that happened were 1975 and 1980. This would suggest that if the rate of inflation does not begin to decline rapidly, nominal yields will have to rise sharply in the future.

Bloomberg

The big problem is that the S&P 500’s earnings over the past twelve months have been about $204, and at 17 times earnings, the value of the S&P 500 would fall to about 3,480. But the more rates should rise, the lower the PE multiple should contract. For example, if the PE returned to the December 2018 low of around 16, the S&P 500 would be worth around 3,200.

Bloomberg

In typical equity market fashion, it has decoupled, while reality is once again reflected in the bond market, the foreign exchange market and federal funds futures. Stocks are usually irrational when they rise or fall, but this time they’ve gone wild, and this recent summer rally may disappear even faster than it was.

The summer fade may be especially true if Powell can deliver a clear, direct message and not a two-faced one. Add to that a set of economic data coming out between September 1st and 3rd, which can likely support rates going much higher and staying there for some time.

[ad_2]

Source link