Torsten Asmus

For those of you who have followed my work, this is a change I decided to make for several reasons. Items require some manual work to update spreadsheets and keep track of dividends coming into accounts. recently years I have added more graphs/charts in the hope that it will add value to readers and bring clarity to what I am trying to do.

In the process of doing this, I’ve made it harder for myself to continue to produce consistent articles and make sure the quality doesn’t suffer. Here are some additional reasons to separate the operations into their own article.

If I have a week where there are no transactions, I can simply skip writing this article because there is no point in providing an update if nothing happens. Currently, my articles talk about transactions made 60 days ago, for example, if I make a trade on June 1st, but the article is published at the end of July. Producing a separate item allows me to deliver actionable trades that are still more likely within a buy/sell range after seven days. My articles have become too long. A busy month can result in a 4,000+ word article and that defeats the purpose of updates.

I’d love to hear feedback in the comments about things you like, don’t like, or even ideas I haven’t thought of/thought of yet. Constructive feedback is something I really appreciate and many of my regulars can attest to the fact that I try to follow these ideas whenever possible. Many of the images in my articles are a direct result of following these comments.

June articles

I have included links to all three of John and Jane’s articles published during the month of June.

Dividend portfolio for retirees: John and Jane’s June taxable account update

Retiree’s Dividend Portfolio – Jane’s June Update: Record Dividends

Retiree Dividend Portfolio – John’s June Update: Dividend levels are approaching pre-Covid-19 levels

July 19 – July 28 Offices

I aim to write these articles weekly (again, only if there’s account activity worth discussing) so I can keep them reasonably short.

Jane’s traditional IRA

7-28-2022 – Jane Traditional IRA Trades (Charles Schwab)

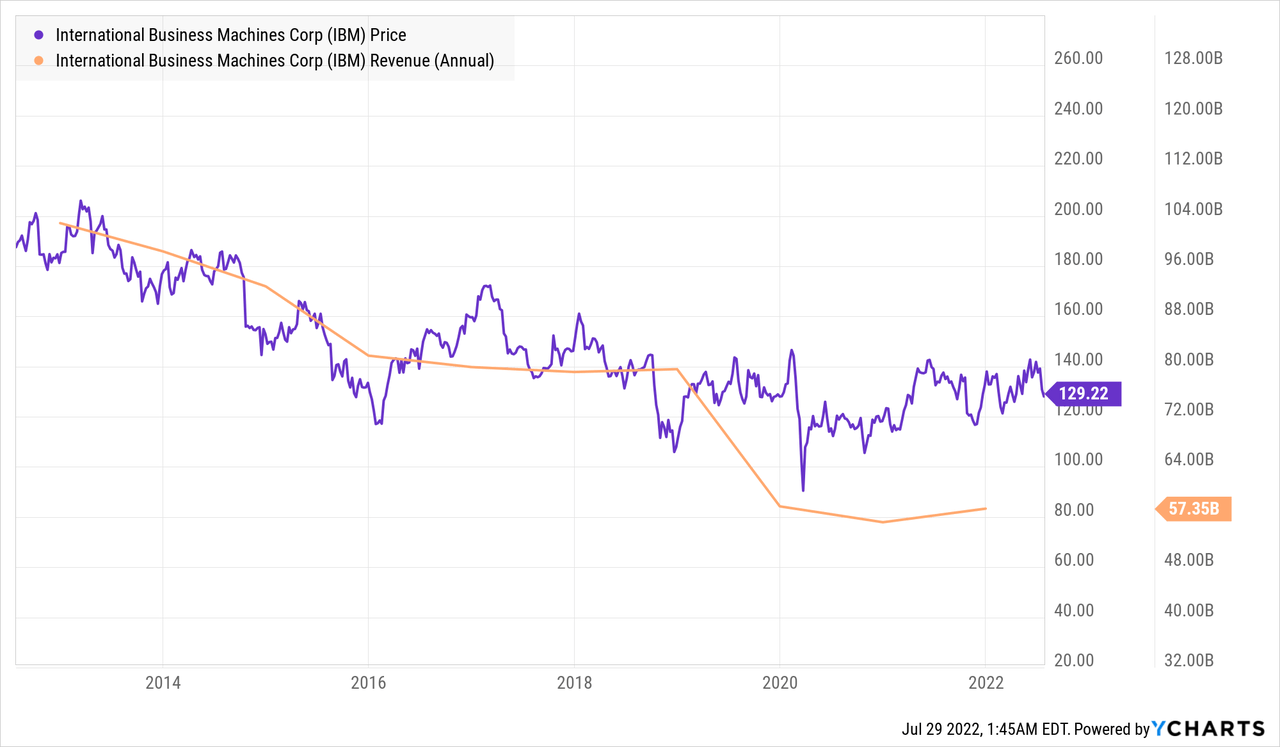

International business machines corporation (IBM)

IBM represents a good buying opportunity when the dividend yield exceeds 5%. IBM’s recent dividend increases no longer make it a major dividend growth company, so the yield has risen in recent years as the market re-appreciates the stock’s potential. I think the company represents modest value following its acquisition of Redhat ( RHT ), which appears to have provided some leverage that should allow the company to reverse the revenue decline that has plagued the stock for more than a decade . We’ve trimmed IBM’s position over the past year by eliminating stocks costing $140 or more, so we see less than $130 per share as a decent entry point. Additional purchases should see the cost per share closer to $120 per share.

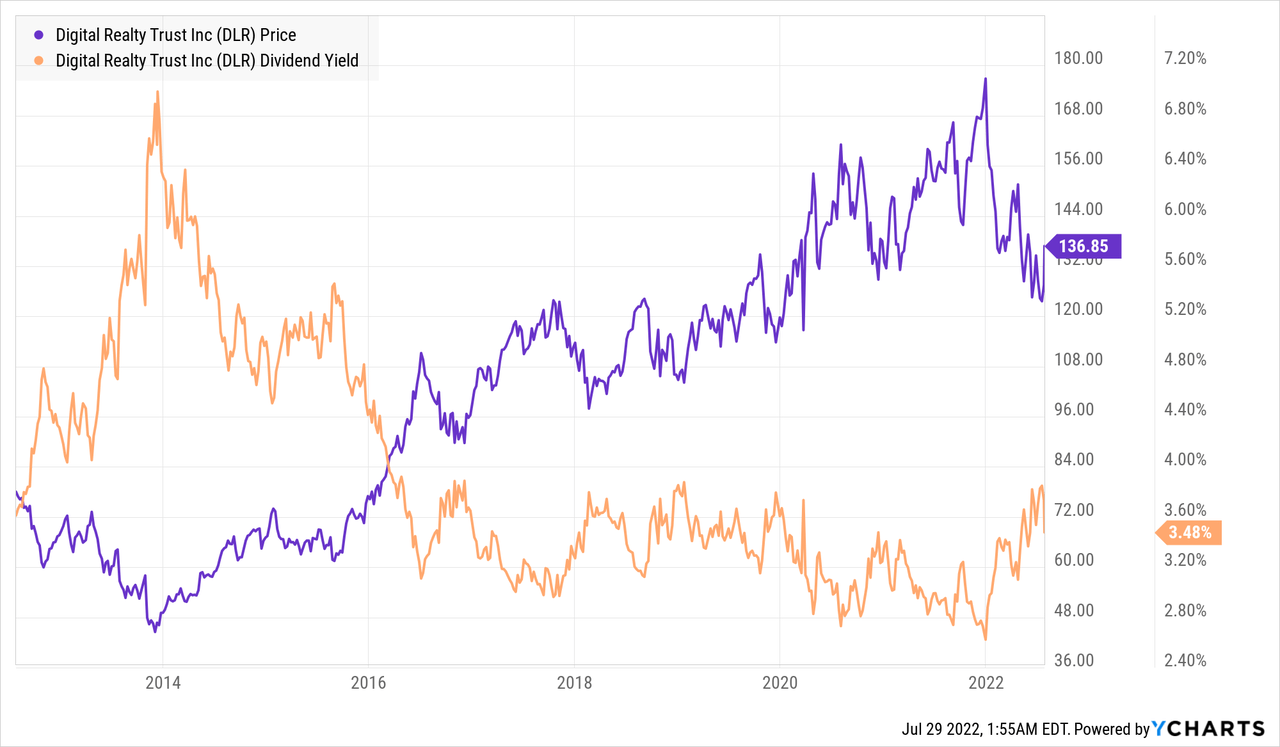

Digital Realty Trust, Inc. (DLR)

DLR has long been a portfolio favorite, hitting all-time highs not long ago (it hit $178.22 per share in January 2022). Now that the stock has fallen to its 52-week low, we added more stock as the yield rose above 4% (this is something that barely happened during COVID, so you can understand that this is not a common occurrence). Even though it’s only been a week, the stock price has risen considerably and is approaching my sell range. DLR is one of those stocks that we have no plans to fully divest from, but we have had great success buying and selling the stock. We have a full position in DLR, but if the stock falls below $120 a share, we would consider adding more. The stock remains a compelling buy below $130 per share for dividend growth investors.

John’s traditional IRA

![]()

7-28-2022 – John Traditional IRA Trades (Charles Schwab)

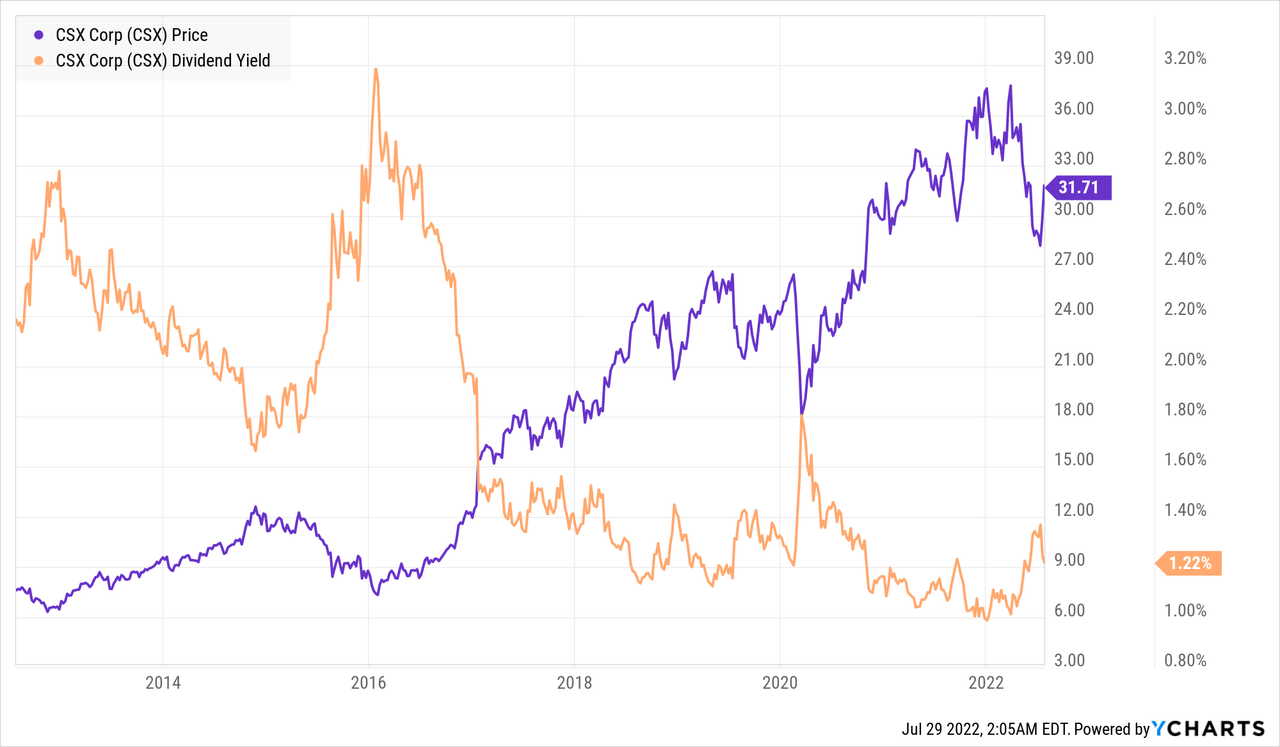

CSX Corporation (CSX)

We bought stock prior to Loop Capital’s stock update and agree with many of the points raised. We see CSX as a solid dividend growth opportunity (with average growth of nearly 10% over the past 10 years) and this has allowed us to increase the number of low-cost stocks that will allow us to cut high-cost stocks cost (the position was initially set at $34.05/share for 75 shares). We will look to add more on any pullback below $30 per share.

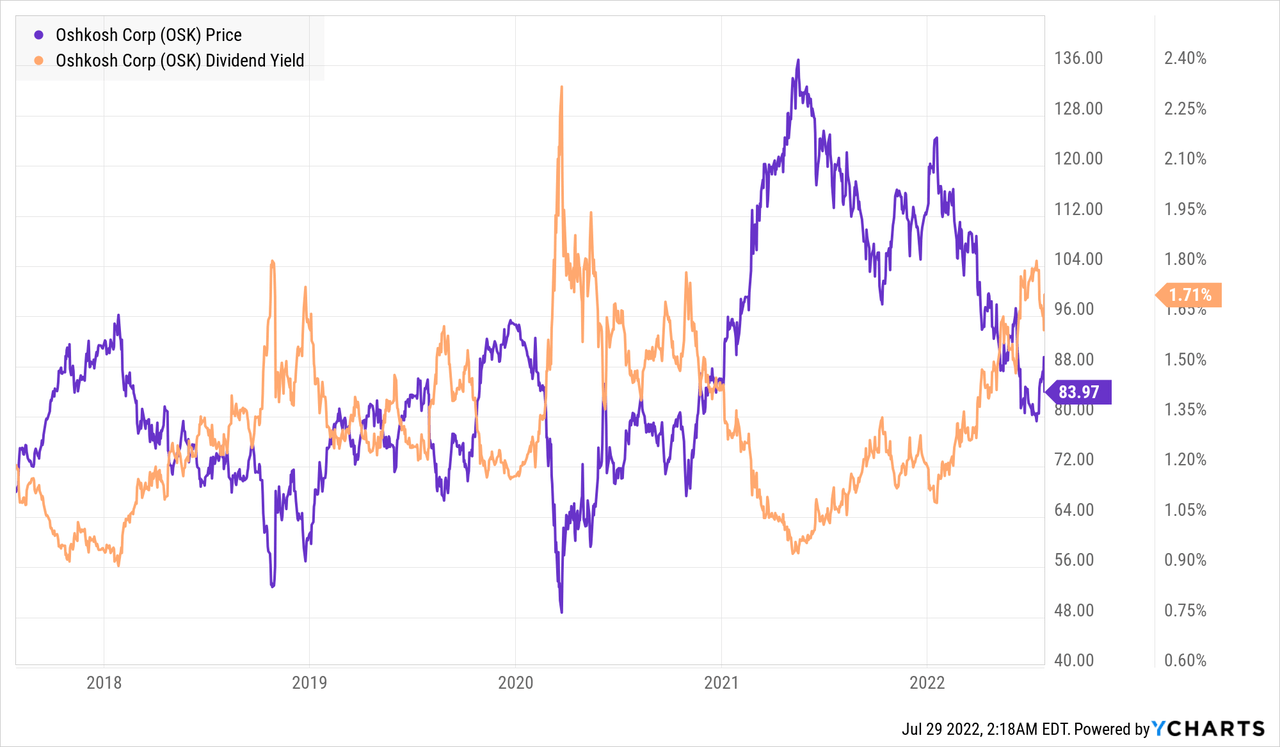

Oshkosh Corporation (OSK)

We established this position prior to the earnings announcement (the stock was down more than 30% from its highs, so we felt it was a reasonable entry point). The earnings report provided insight into supply chain issues and inflationary pressures. That is why we have only initiated an initial position and expect there to be challenges moving forward that may continue to hamper performance. Either way, I wouldn’t recommend OSK yielding less than 1.75% (in fact, I’d wait to see if the stock falls below $80/share to yield 1.85% before add/set position). OSK has a great business model and is responsibly managed, but faces challenges that will likely affect them in the coming year.

John’s Roth IRA

![]()

7-28-2022 – John Roth IRA Trades (Charles Schwab)

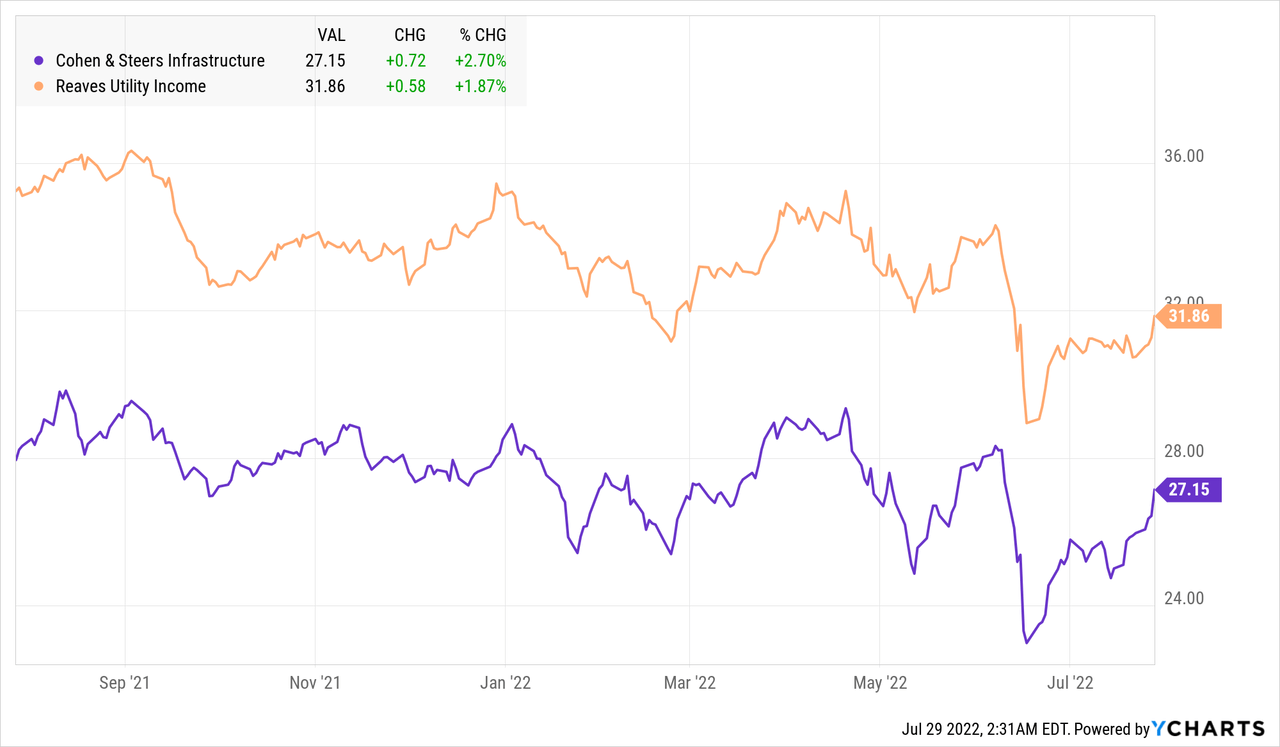

Cohen&Steers Infrastructure Fund (UTF)

We added 175 stocks to the UTF position in 2022 alone. June and early July saw strong entry values, but these have dissipated quickly with the stock moving sharply above $27 per share. At these levels, we don’t expect to add any more shares anytime soon, but if they move enough (closer to $29 per share) we would look to sell some of the high-cost shares acquired over a year ago. I think UTF above a 7% yield is a reasonable entry point, but with the size of this position we would be looking closer to $25/share or a 7.5% yield. This is a large closed-end fund that provides exposure to many critical infrastructure, rail and utility REITs. Potential investors might also consider UTG as another alternative to UTF, especially since UTF seems to have closed the gap somewhat in recent months. We personally like UTF holdings better than UTG, but UTG currently offers a higher yield than UTF and also pays monthly.

Recent/Pending Limit Transactions

There were no sales during the time period covered by this article, however, we have placed several limit trades in an attempt to reduce our exposure to positions in high-cost stocks that are above current/recent values. Typically, these types of sales occur after the number of shares has increased, but on the low cost side. In other words, limit orders generally focus on reducing the overall position size after purchasing shares at a much lower cost.

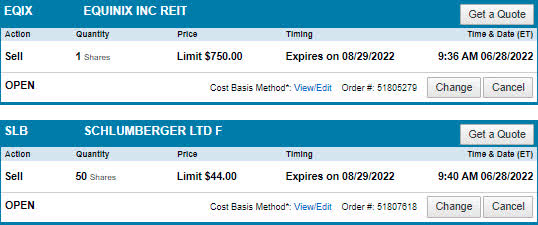

Taxable account pending limit operations

7-28-2022 – Taxable account limit transactions (Charles Schwab)

Equinix, Inc. (EQIX)

EQIX has seen its share price rise recently and the stock to be sold is the highest cost share at nearly $50. The recent weakness appears to be short-lived with a recent Oppenheimer upgrade to overcome it. We can actually add stocks to the current entry point because there seems to be momentum behind EQIX and the article 6 Myths Wrecked: Strong Buy Equinix by Colorado Wealth Management is another well written article that really puts a wrench in the bear argument against EQIX. .

Schlumberger Limited (SLB)

We bought shares of SLB during the initial phase of COVID and this allowed us to accumulate a lot of low cost shares. SLB recently raised full-year revenue guidance and has seen very positive developments including strong drilling activity and increased offshore drilling. Similar to EQIX, we can buy more shares at current prices while leaving the trade limit in place.

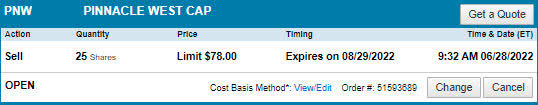

John’s Roth IRA Pending Limit Trades

7-28-2022 – John Roth IRA Limit Trades (Charles Schwab)

Pinnacle West Capital Corporation (PNW)

The position in PNW was established at a higher stock cost of more than $80 a share and then immediately reduced after Arizona’s utility regulator denied its request to raise rates. We bought a large number of shares near the bottom and now that the share price is recovering, we are looking to unload some of the initial shares and put cash back into reserves for future purchases.

conclusion

While my goal was to provide useful insights, some of the stocks in this article have seen significant changes in their share prices over the course of a week. That said, there are still some opportunities for dividend investors.

Using limit trades is a great way to make sure you don’t miss out on selling high-cost stocks when the opportunity arises. The amount of movement in some of these stocks demonstrates the importance of using limit trades if selling high-cost stocks is part of your strategy.

John and Jane are long all values mentioned in this article.

[ad_2]

Source link