News by Drew Angerer/Getty Images

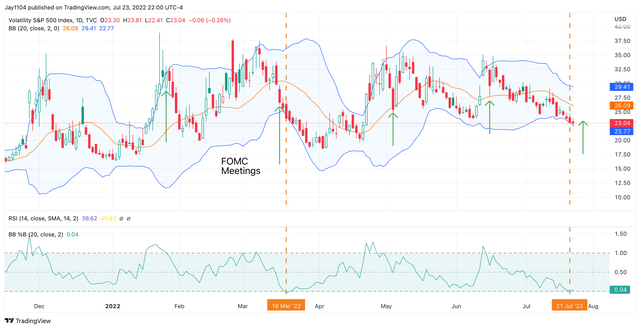

The week of July 25 will be a big one for the markets, with the FOMC meeting on Wednesday afternoon. I pointed out last weekend that the markets could have a major drop, and I still think so this is likely to happen. Unfortunately for me, it looks like my time may have been wasted by a few days as the VIX fell all week.

This suggests that the market is either playing a game or very complacent, heading into a crucial week. The VIX index ( VIX ) is trading around 23 at its lowest level leading into an FOMC meeting this year. The day before the previous four FOMC meetings in 2022, the VIX closed above 29 each time. So not only is the VIX low ahead of the FOMC meeting, but if it stays at that level or falls, it will be exceptionally low. So either this is a trap the market is setting for the bulls, or this market is completely underestimating the importance of this week’s FOMC meeting.

Commercial view

Also, the VIX is now very oversold and is even trading below its lower Bollinger Band, suggesting that the index may be near a low point and due for a big rally to the top of its Bollinger band.

Commercial view

More measure of complacency

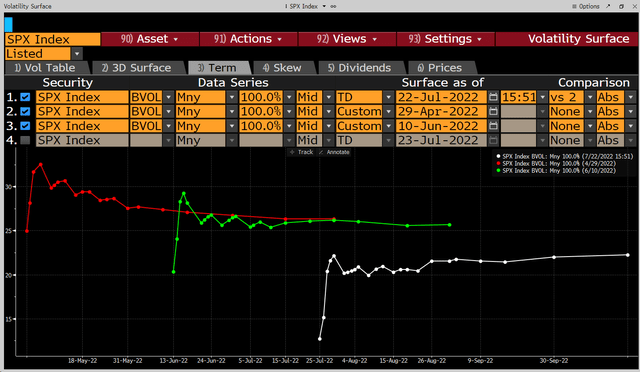

The implied volatility term structure of S&P 500 options can be used to better understand how complacent the market is. By looking at this term structure and comparing the current structure to the Friday before the June FOMC meeting, you can see that the existing term structure is significantly lower.

An at-the-money option for the June 15 expiration date had an implied volatility of about 28.5% on June 10. As of July 22, an at-the-money option for July 27 expiration has an implied volatility level of nearly 8% percentage points lower, 20.4%. It seems that the market is not taking this week’s event as seriously as in the past. Heading into the May FOMC meeting, an at-the-money option for the May 4 expiration date was 31.9%, making the implied volatility difference between the May and June FOMC meeting was only 3.4%.

Given the low levels of implied volatility, the market seems to be taking this meeting almost as a non-event.

Bloomberg

The market is underestimating the Fed

This complacency may be happening because the market has become convinced that the Fed is close to pivoting, yielding, and returning to its old ways of supporting asset prices. This week’s meeting may change the market’s mind about how serious the Fed is about its battle against inflation and that it does not see the economy as weak or headed for a recession.

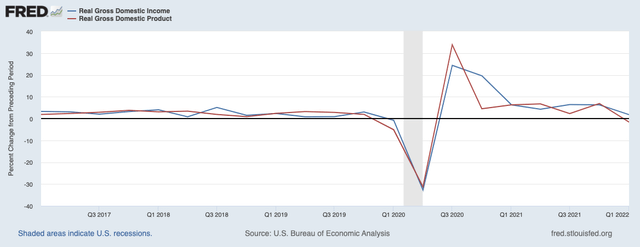

FOMC board member Chris Waller recently gave one interview and was explicitly asked about the potential for a second quarter of negative GDP growth. In this interview, Waller revealed that gross domestic product and gross domestic income were diverging and that while GDP was trending lower, GDI was not. He noted that these two measures of the economy are expected to trend in the same direction and believes that GDP at some point is likely to be revised higher, and the GDI is perhaps likely to be adjusted slightly lower. But the strength of the labor market and the GDI numbers would suggest that the economy is neither in recession nor headed for one. He also noted that negative GDP impressions could be due to export category measures that are undermining how the domestic side of the economy is doing.

Looking at it in more detail, while real GDP was negative in the first quarter, real GDP increased by 1.8%. This suggests that perhaps the economy was not as weak as the GDP report made it out to be. If the Fed takes into account these other factors, such as the GDI when considering the growth and strength of the economy, this could be problematic for a market that is now waiting for a Fed pivot.

COLD

Ironically or not, this issue came from GDP and GDI came out at the last FOMC minutesand participants pointed to conflicting signals between GDP and GDP in terms of the pace of economic growth and that the labor market was very tight.

Worrying signs for a Fed pivot

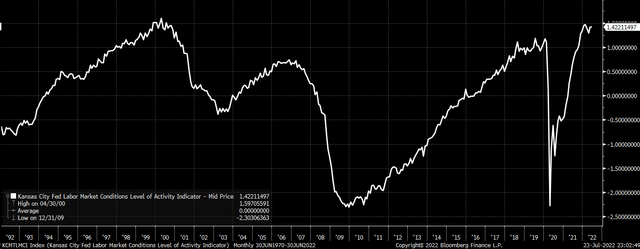

When you dig deeper, the latest data from the Kansas City Labor Market Conditions Index, as of June 30, showed that the index was still at its highest level since the late 1990s.

Bloomberg

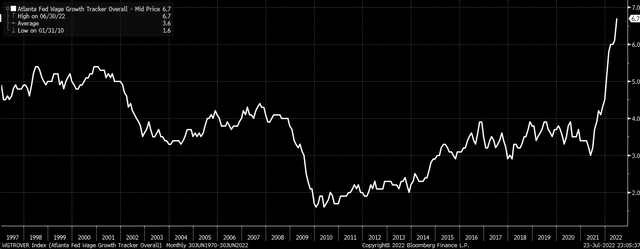

Also, the Atlanta Fed’s wage growth tracker hit a new high in late June. This was its highest level on record since 1997. At this point, the tracker has been climbing vertically and shows no signs of peaking yet.

Bloomberg

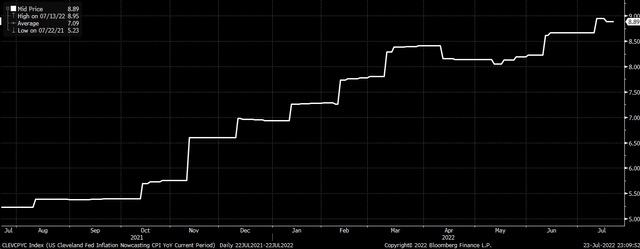

Even the Cleveland Fed’s CPI forecast projects a July CPI y/y rate of change of 8.9%, which would be just two-tenths less than the 9.1% rate of change of the June CPI.

Bloomberg

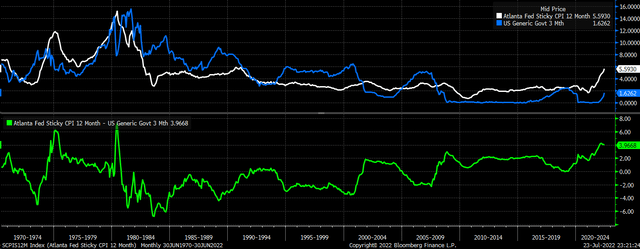

Meanwhile, the Atlanta Fed Sticky’s 12-month inflation forecast currently stands at 5.6% and, like many of the aforementioned indicators, is rising sharply and vertically. The last time this index had such a high reading for persistent inflation was in April 1991, when the three-month Treasury rate was nearly 5.7%. The spread between the sticky measure of inflation and the 3-month Treasury note was last this wide in July 1980.

Bloomberg

What this all comes down to is that so far the Fed has had little to no impact on its mandate to return inflation to its 2% target, and the Fed can find plenty of metrics to use to ignore the concerns of slowing growth if they so choose to meet their inflation target.

The other point is that if inflation is becoming as sticky and entrenched as some of these forecasts suggest. Rates may have to rise further than the Fed has currently protected, and a couple of quarters of negative inflation-adjusted real GDP won’t stop them.

If that’s the message delivered this week by the Fed, then the stock market is not only too complacent, it’s in for a big shock.

[ad_2]

Source link