Katie Stockton: The current market is a cyclical bear in a secular bull

Katie Stockton, Founding and Managing Partner of Fairlead Strategies, joins Worldwide Exchange to discuss the likelihood of an improvement in short-term momentum, a rebound in the coming weeks, and an oversold bounce.

Read More »

Brian Sullivan’s RBI: Rising housing rates and mortgage costs

Brian Sullivan’s daily RBI segment on Worldwide Exchange focuses on Redfin’s new data around the cost of buying a home as interest rates spike.

Read More »

Wieting: Recession isn’t a necessary component of how we get to a lower inflation rate

Steven Wieting of Citi Private Bank discusses the odd for a U.S. recession, resolving the global supply chain crisis, and whether we’ve seen the peak of rates yet this year.

Read More »

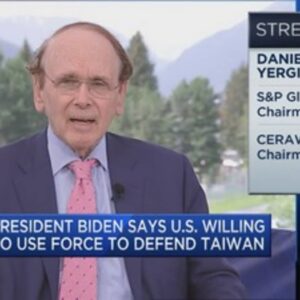

Yergin: Natural gas supply is causing the most concern for industry and consumers

S&P Global vice chairman Dan Yergin discusses global energy and food security, Europe’s attempt to reduce dependence on Russian oil & gas, and the shift to renewable energy from the sidelines of the World Economic Forum in Davos.

Read More »

Patrick Palfrey: Much of the sell-off has been driven by elevated valuations

Patrick Palfrey, Senior Equity Strategist at Credit Suisse, joins Worldwide Exchange to discuss the value of the U.S. dollar, the possibility of a recession, and investor fears of entering a bear market.

Read More »

Brian Sullivan’s RBI: Credit Suisse’s Top Picks to Outperform

Brian Sullivan’s daily RBI segment on Worldwide Exchange focuses on a recent report from Credit Suisse listing 50 stocks that will benefit from a stronger U.S. dollar.

Read More »

Robert Teeter: Against the inflation backdrop, extend your time horizon

Robert Teeter, Managing Director at Silvercrest Asset Management, joins Worldwide Exchange to discuss what is driving downside momentum, whether a recession is coming, and what companies to invest in against this choppy backdrop.

Read More »

Bell: Increased volatility is a reflection of investors grappling with the direction of the market

Lindsey Bell of Ally Invest says volatility is likely to continue until investors get more clarity on which way inflation is moving, how fast it’s moving, and the trajectory of the Fed’s interest rate policy.

Read More »