AT&T is one you want to buy during a volatile period, says Captrust’s Christian Ledoux

Christian Ledoux, Captrust director of investments, joins ‘The Exchange’ to discuss the markets, equities and stocks to invest in.

Read More »

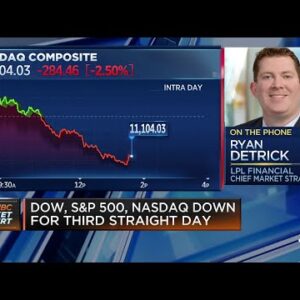

We don’t see a recession, but more of a slowdown, says LPL’s Ryan Detrick

Ryan Detrick, LPL Financial chief market strategist, joins ‘The Exchange’ to discuss whether we’re in a bear market and if we’re headed toward a recession.

Read More »

Freight flows continue to go up, says Donald Broughton

Donald Broughton, Broughton Capital managing partner, joins ‘The Exchange’ to discuss the economy and transport stocks.

Read More »

We may be headed for recession in 18-24 months, says Jefferies’ Aneta Markowska

Aneta Markowska, Jefferies chief financial economist, joins ‘The Exchange’ to discuss the economy and the Fed.

Read More »There’s tremendous opportunity in semiconductors and semi equipment, says Goldman’s Brook Dane

Brook Dane, Goldman Sachs managing director, joins ‘The Exchange’ to discuss tech stocks.

Read More »

Retailers focused on low-income consumers will face tough sledding, says Truist’s Scot Ciccarelli

Scot Ciccarelli, Truist retail analyst, joins ‘The Exchange’ to discuss consumer pricing power and how lower-income consumers could be hurt worst in this economy.

Read More »

Things in U.S. may get as challenging as Europe, says First Eagle’s Matthew McLennan

Matthew McLennan, First Eagle Investments manager, joins ‘The Exchange’ to discuss long-term value stocks.

Read More »

Evidence is that we’re in a bear market, not a regime shift, says Oppenheimer’s Ari Wald

Ari Wald, Oppenheimer head of technical analysis, joins ‘Power Lunch’ to discuss the characteristics around today’s equity market sell-off, whether an S&P 500 rally would be real or a head fake and more.

Read More »