In ours last post from weekly market review section, we discussed earnings season, the consumer sentiment index and the inflation reading. Now it’s time to see what the drivers are for next week.

For a full list of top stock market events and updates, check out our economic calendar’.

Next week. An image composed by the author using Canva (affiliate link)

Markets continued their recovery last week amid positive macroeconomic developments, including a strong labor market and lower-than-expected inflation data. This was the fourth straight week of gains for the market, not seen since October 2021.

The S&P 500 is now 15% off its June lows, while the Nasdaq is up 20% from its lows. Markets will prepare for key housing and sales data next week, which will determine whether shares will continue to increase further.

The US Federal Open Market Committee (FOMC) will publish the minutes of the meeting held on Wednesday, July 26-27. Markets will keep a key on the release for guidance on broader macroeconomic data, including inflation and recession. Additionally, market participants can also try to look at the minutes of the meeting to interpret the timeline and pace of more interest rate hikes.

The U.S. Census Bureau will report retail sales data for July on Wednesday, which will indicate whether consumer spending remains strong despite the persistence. inflation and the deterioration of family wealth.

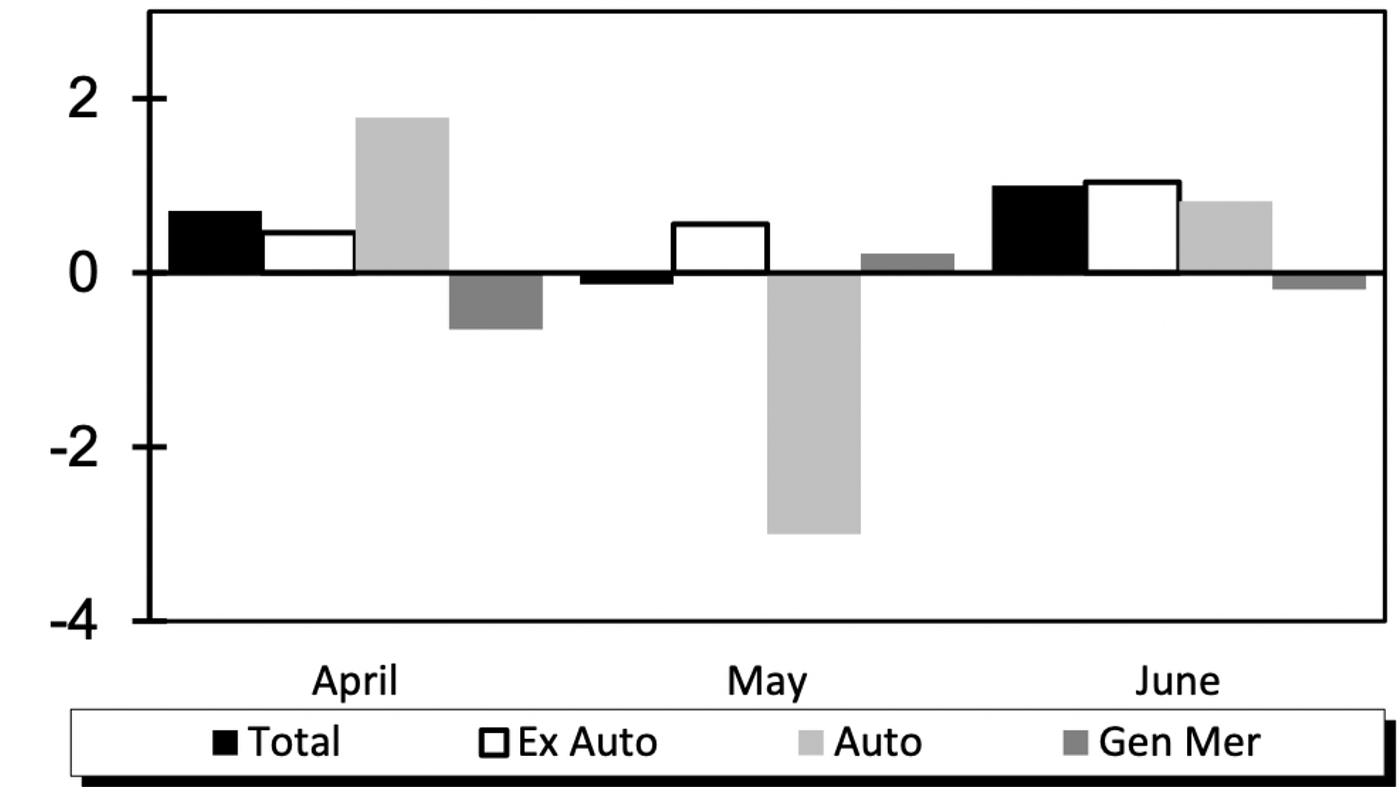

% change in retail and food sales from April to June, Source: US Census Bureau

% change in retail and food sales from April to June, Source: US Census Bureau

July retail sales are expected to rise 0.1% from June, when sales grew 1%, but have slowed significantly since the start of the year due to increased the inflation Markets will also look at key earnings releases from retailers including Walmart, Target, Home Depot and Lowe’s, further charting consumer strength and the impact of inflation on spending.

The week ahead is packed with key housing market updates, including new home starts and existing home sales. On Wednesday, the U.S. Census Bureau will report new housing starts and building permits for July. Consensus forecasts show that new housing starts are expected to fall to 1.5 million units in July from 1.56 million in June. affordability reaches a minimum of 33 years

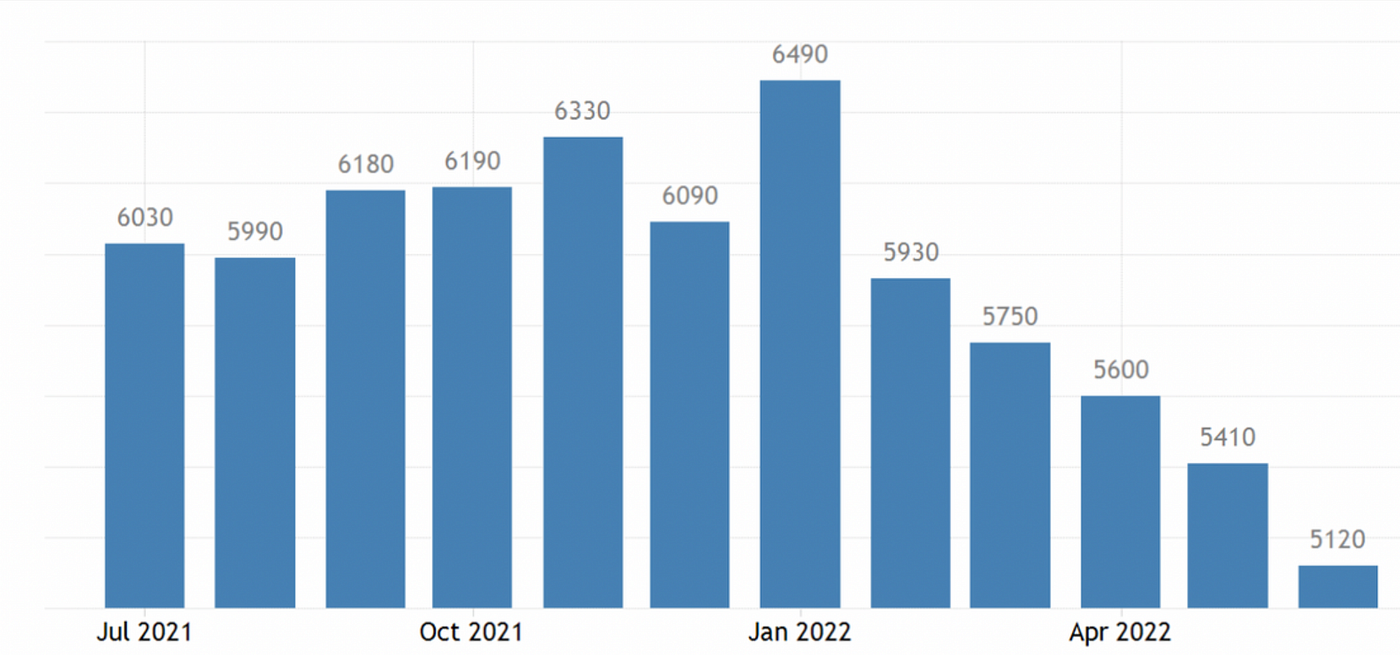

US Existing Home Sales, Source: Economics of trade

US Existing Home Sales, Source: Economics of trade

On Thursday, the National Association of Real Estate Agents is expected to release existing home sales in July, which are expected to decline 8% from June as a combination of rising mortgage rates, skyrocketing home prices and declining affordability. The drop in housing data could signal a slowdown in the economy and potentially encourage the Fed to slow the pace of rate hikes.

S&P 500 chart. Source: TradingView

S&P 500 chart. Source: TradingView

Markets have continued to rise in recent weeks on strong economic data. Key housing and retail sales data, along with FOMC meeting minutes, could guide where stocks are headed next week.

[ad_2]

Source link