images_lindsay

This article was originally published for Reading The Markets subscribers on July 30, 2022

The S&P 500 (SP500) rallied dramatically in recent days. Some people have attributed this to the Fed’s “dovish” pivot, which in reality does not exist. But what does exist is the liquidity that has moved into the market in recent days as margin conditions have softened and uses of the overnight repo facility have stagnated.

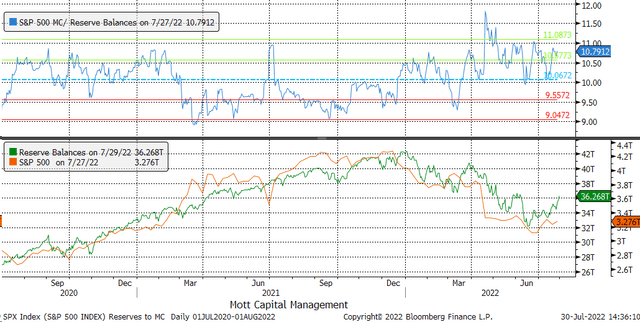

Last week, reserve balances at the Federal Reserve’s depository institutions rose slightly to $3.276 trillion from $3.235 trillion, not a significant overall change. But for July, reserve balances rose from a low reading of $3.116 trillion in June. The increase for the week and month provided liquidity, helping to propel stocks higher after a sizable decline in June.

Bloomberg

The ratio of S&P 500 market cap to reserve balances expanded in July from a June 14 low of 9.94 to 10.75, pushing the market cap ratio to reserve balances at the upper end of the historical range since July 2020.

Typically, when the ratio is around 10.75, it has marked a market high, such as February 2, 2022, March 29, April 20, May 27, and June 27 . It doesn’t mean the index has to see a new low. Still, it has marked near-term highs and, depending on the overall movement in reserve balances, may mark a turning point like the one seen during most of these peaks in 2022 because reserve balances, in generally, they have been going down.

Bloomberg

leverage

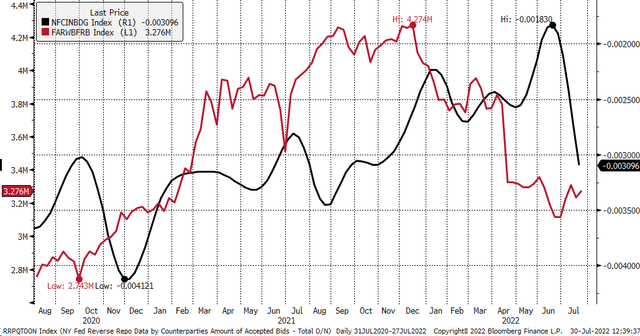

Additionally, the Chicago Fed’s weekly NFCI financial conditions index reveals that margin conditions have eased significantly in recent weeks. The NFCI margin index measures how easy or tight conditions are to access margin, with a reading above 0 indicating conditions that are tighter than average and a reading below 0 indicating conditions that are looser than average . Thus, as the level rises, it suggests a tightening of margin conditions and as it falls, a tightening of margin conditions.

Access to additional leverage is likely why we saw a lot of movement in the market in recent weeks, despite a relatively small increase in reserve balances since late June. Changes in reserve balances appear to have both a positive and a negative effect on margin and leverage conditions. Falling reserve balances lead to tightening leverage conditions, while rising reserve balances lead to easier leverage conditions.

Bloomberg

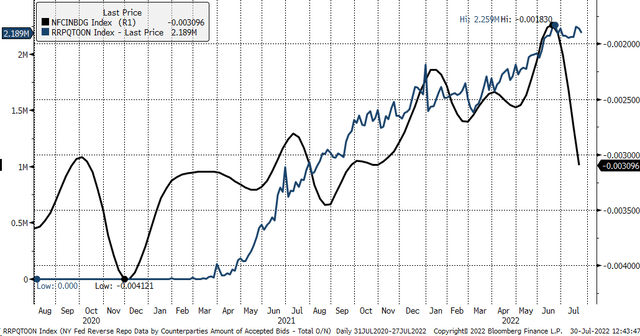

When this is explored more closely, changes in leverage conditions appear to be directly related to the Fed’s use of reserve repo activity. Reserve pension totals have a direct impact on reserve balances, with higher pension totals reducing reserve balances and lower bread totals increasing reserve balances.

Reverse repo activity has been steadily increasing since it was introduced in March 2021, and leverage conditions have steadily tightened over that time. When the use of reverse recovery is actively increasing, the margin conditions tighten while they tighten when the use of reverse recovery falls. It also appears that when repo usage is stable, leverage conditions also widen. Reserve repo activity was flat for most of July, likely leading to an easing of margin conditions.

Bloomberg

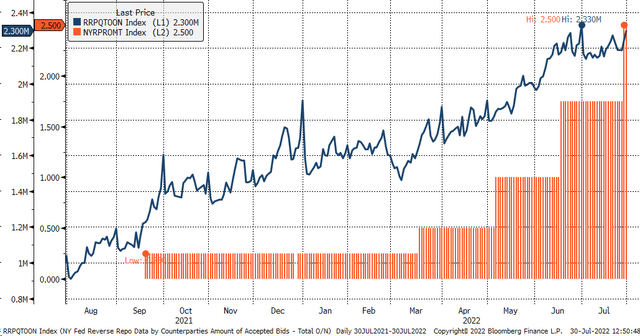

Higher rates

But that may soon change because reverse repo activity appears to increase when the Fed changes interest rates. There was an increase in repo activity after the Fed’s rate change last week, but that was also at the end of the month and tends to increase activity at the end of the month. This use of the repo installation will need to be monitored. If it rises this week beyond $2.3 trillion, that would likely result in a tightening of leverage conditions and work to reduce reserve balances, which is bad for stocks, and would indicate that there is likely there should be a decline in the coming weeks.

Bloomberg

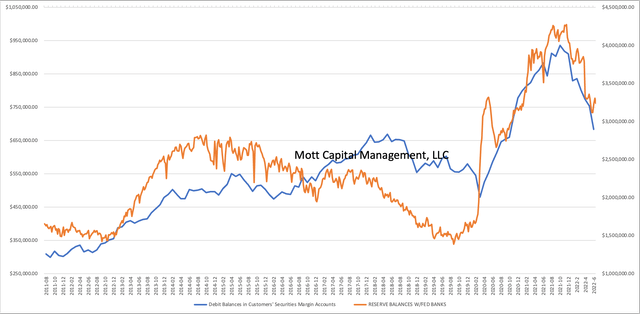

Based on this information, FINRA margin debit balances should have increased by July. Reserve balances and FINRA margin debit balances have been tracked very closely for several years.

Mott Capital

If the Fed’s higher interest rates serve to draw more money from money market accounts into the overnight reverse repo facility, it seems likely that access to margin will begin to tighten and bank balances reserves start to fall, which is negative for asset prices. Remember that most of the money invested in reverse repos comes from money market accounts. If that money is used to get the higher, risk-free rates of the overnight repo facility, it will not go to the stock market, or any other market.

[ad_2]

Source link