Ultima_Gaina

History can serve as a guide, not because it can predict the future, but because it can sometimes prepare us for what may happen next. Investing is very important to understand the fundamentals and technical trends. But the element that is lost most of the time is the emotion, and it’s the emotion of how people respond to news or events that seem to endure, shaping history.

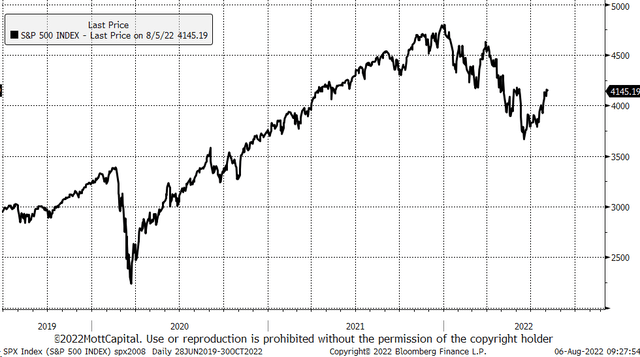

Similarities in today’s stock market and the S&P 500 (SP500) echo the great bear markets of the past. The S&P 500 path 2022 has followed the paths of the 1936, 2000 and 2008 cycles. It does not mean that the future is on a predetermined course; is not. But it can give us a glimpse of what might happen next based on how bear markets and emotions have driven past performance.

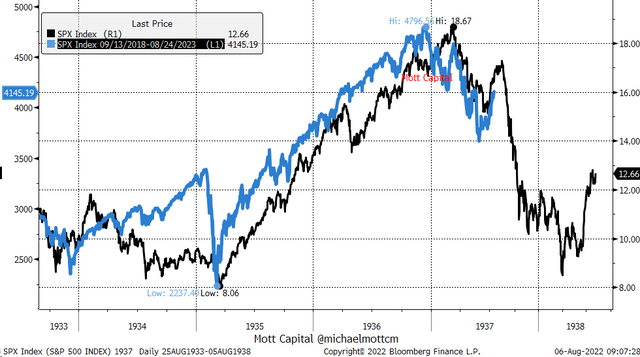

1937

After the recovery from March 1935 to March 1937, the S&P 500 fell sharply by the summer of 1937, nearly 19%. That’s when the index saw a solid summer rally, which lifted the S&P 500 more than 14% from its lows, peaking around August 20, 1937. After that summer upswing, the market fell sharply, almost 70% between September 1937 and April 1938. .

Using a 31,065-day offset to overlay today’s S&P 500 against this bear market, we can see that today’s S&P 500 has charted a course very similar to that of 1937. I would suggest that today’s S&P 500 is likely to reach a turning point in the coming weeks. It could cause the recent rally in 2022 to continue, the comparison to 1937 no longer works, or the S&P 500 in 2022 to drop sharply like the market did in 1937.

Bloomberg

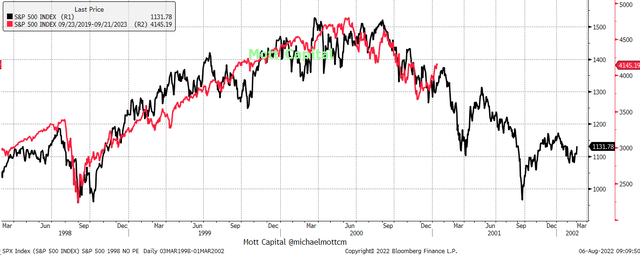

2000

The bear market that began in 2000 also shares many of the same properties as the S&P 500 today. In this case, with an offset of 7874 days, the two charts will line up. After the 1998 selloff, the S&P 500 rallied sharply into 2000. The 2000 S&P 500 was more resilient at first, retesting its March 2000 highs again in September 2000. Then from that, the index saw a sharp sell-off, followed by a rally in January 2001. That January 2001 rally marked the final rally, followed by a nearly 20% decline in April 2001 .

Again, the current market is at the same time. So, if the S&P 500 is going to go down and follow the path of 2000, that sharp decline could happen in the coming weeks.

Bloomberg

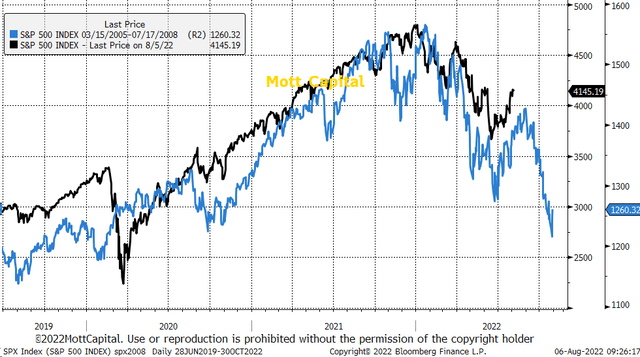

2008

Finally, the 2008 bear market appears to be more in line with the S&P 500 in 2022. A 5,218-day offset aligns the double bottom in the fall of 2020 with the double bottom in the spring of 2006. Like the previous two bear market examples, after peaking in October 2007, the S&P 500 has been on a slow and steady decline. of close to 19%. A rally followed in the spring of 2008, resulting in a gain of almost 12%. Of course, after that rally, the S&P 500 found itself lower again, erasing the spring gains.

Bloomberg

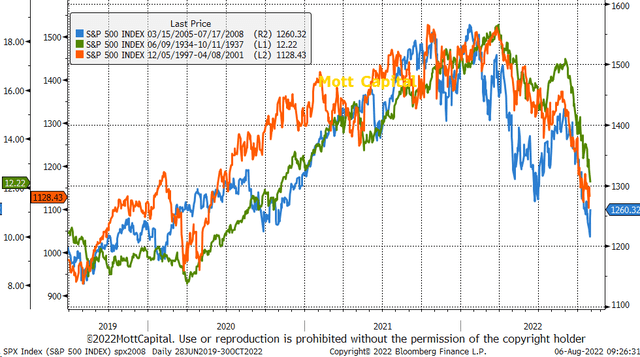

similarities

The declines may be different in each of these cases, but the reason is not what matters. It’s the patterns the market followed that matter. When the years 1937, 2000 and 2008 are superimposed together on a graph, they show that the bull rally phases were of almost equal duration, with a peak in a 6-month period, followed by a sharp decline, and a very strong countertrend rally. for a significantly steeper decline.

Bloomberg

Does this mean the 2022 market has to follow the same path? No, of course he doesn’t. But if we are in a bear market and the pattern continues, the market may be entering the most dangerous part of the bear market. The part where a powerful build-up catches everyone off guard and is followed by a sharp and sudden descent.

Bloomberg

What happens next for stocks is anyone’s guess, and these charts don’t tell us what that outcome will be. But the power of story and human emotion tell us what might happen next, and in this case, the answer may be staring us in the face for all to see.

[ad_2]

Source link