Krejci clothes

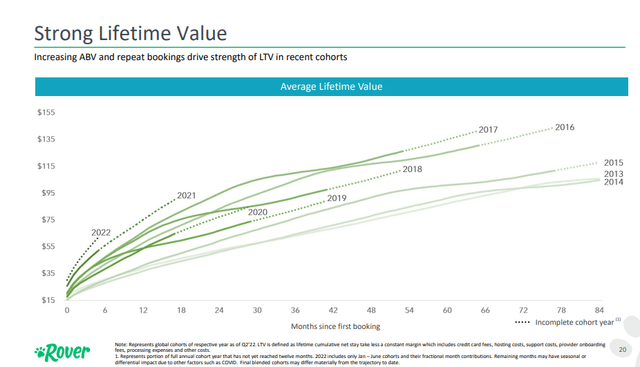

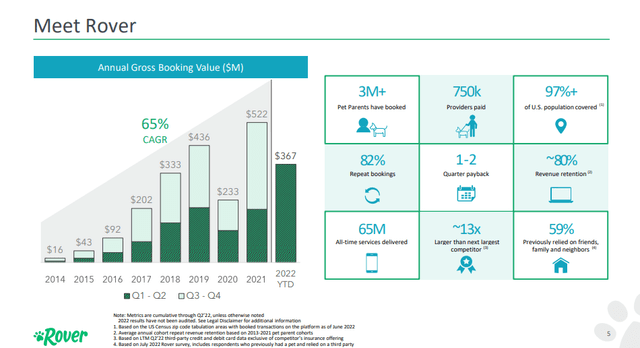

rover (NASDAQ:ROVR) reported another strong quarter, although guidance for the next quarter was slightly below expectations. In addition to the strong figures for the reported quarter, there was also positive news on other fronts. For example, the company shared that the lifetime value of customers acquired this year is the highest to date. Revenue per customer, less cost of revenue and support, is trending higher than the 2021 cohort, which was already one of the top cohorts.

Rover Investor Presentation

This leads us to continue to believe that this is a high growth company with attractive customer unit economics and therefore a lot of potential. One disappointing thing was that cancellation rates picked up toward the end of the quarter, and that’s one of the reasons they’re lowering guidance for next quarter. While the company delivered a strong second quarter and continued to gain market share, the company sees reason to be cautious for the second half of the year. So the company is slowing hiring and marketing spending.

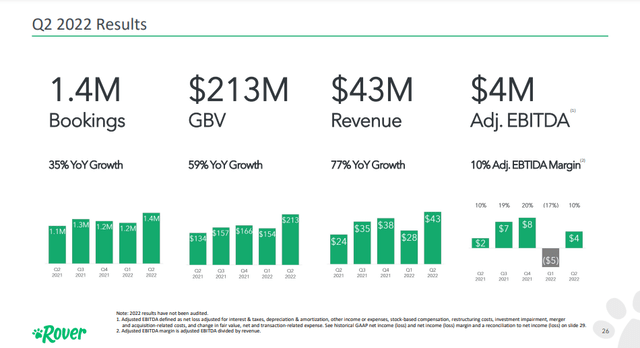

Results 2Q 2022

Key statistics for Q2 2022 results are below, note that VG continues to grow well, thanks to a combination of booking growth and spend per booking. The largest absolute growth in international markets was Canada and the United Kingdom. The company returned to profitability on an adjusted EBITDA basis, with an adjusted EBITDA margin of ~10%. Revenue grew even faster than VG as the company’s acquisition rate increased.

Rover Investor Presentation

finance

Second quarter revenue exceeded guidance, thanks to the increase in the average value of reserves and the strength of European reserves. Meanwhile, the average booking value in the second quarter was $147, an increase of 18% year-over-year, driven by the increase in the average service price of pet care providers. This growth in ABVs, along with strong retention rates, has increased expected LTVs.

For us, the most important KPI remains annual gross booking value, which is fast approaching $1 billion.

Rover Investor Presentation

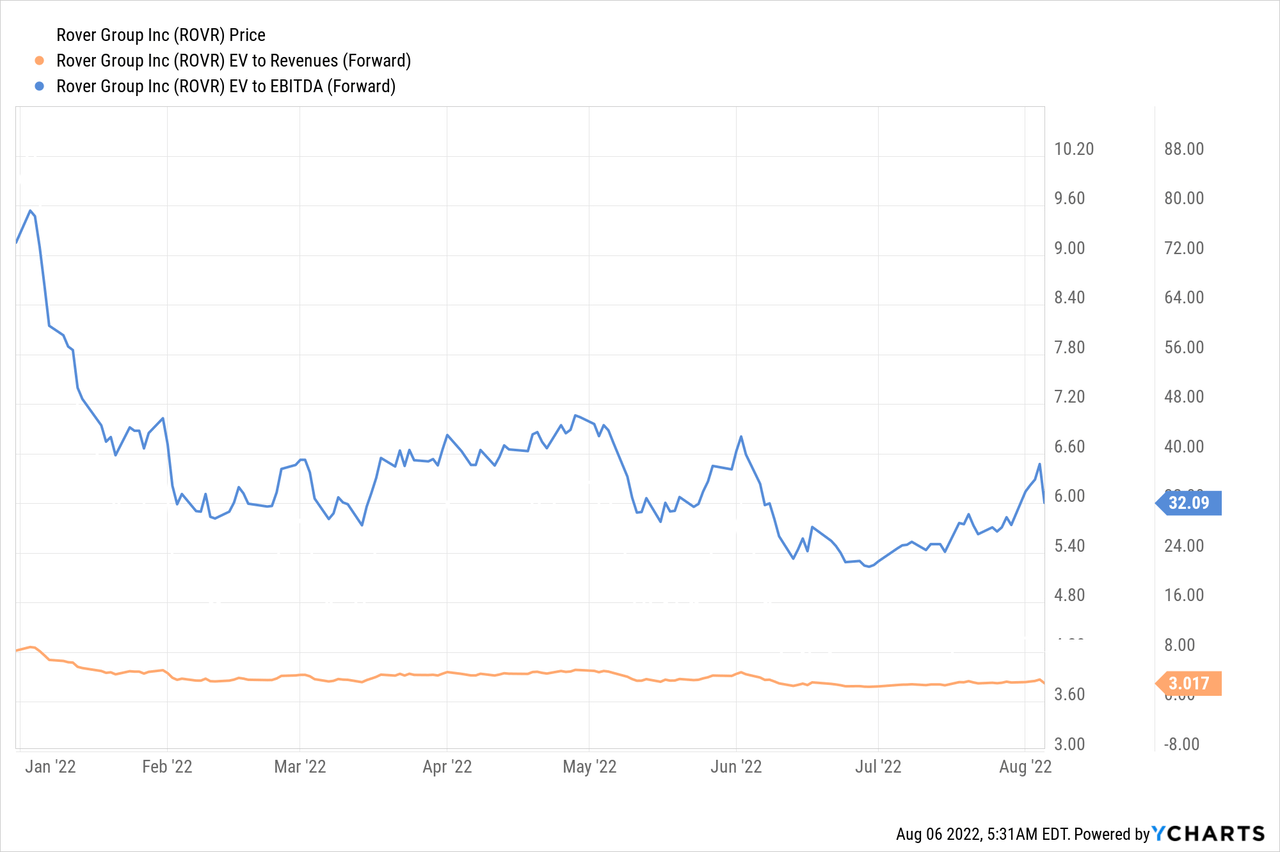

Evaluation

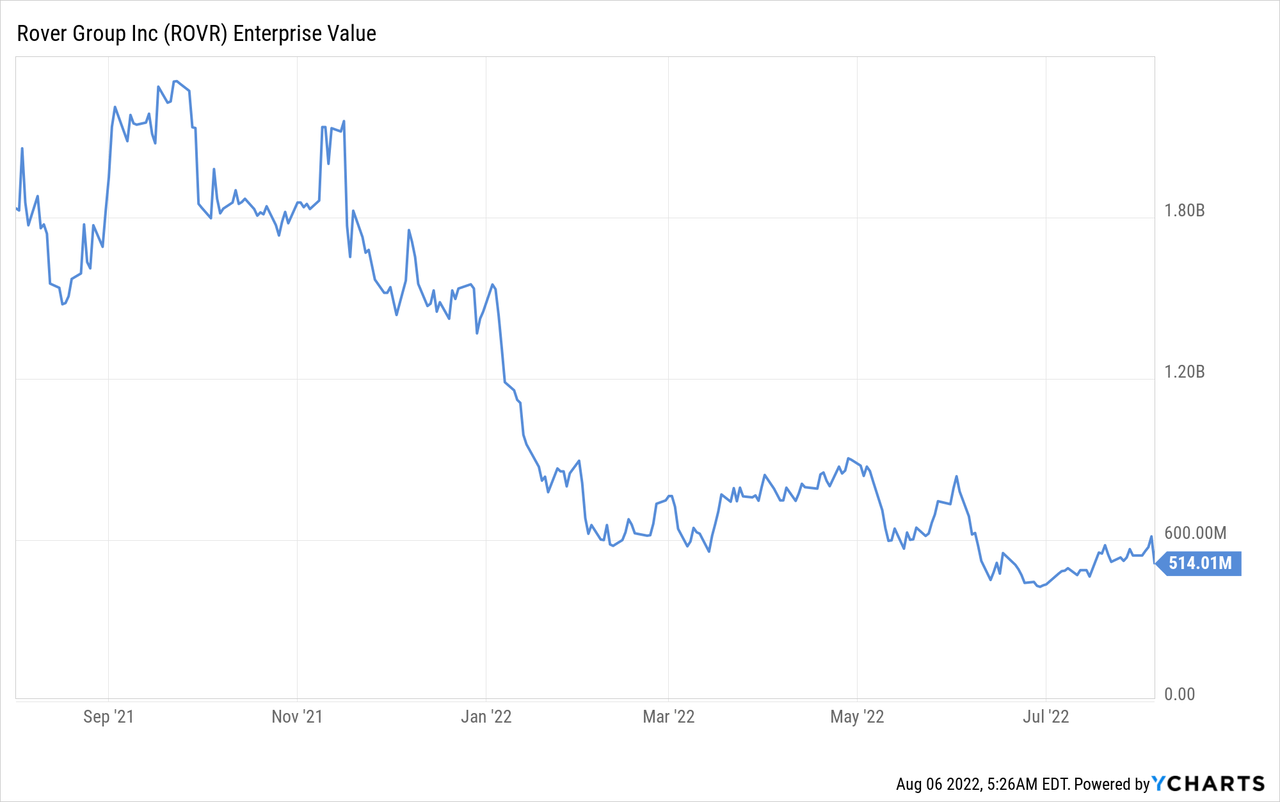

The company continues to have a large amount of cash, cash equivalents and short-term investments. That is why the value of the company is significantly below the market capitalization. The company is currently valued at around $500 million, which is below the expected annual gross reserve value, which is one of the reasons we believe the company is undervalued.

Enterprise Value ROVR data for YCharts

Enterprise Value ROVR data for YCharts

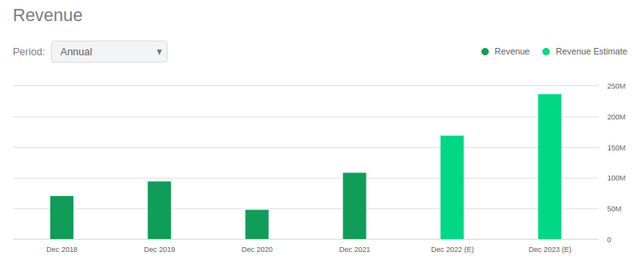

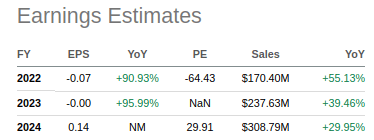

For a platform company with network effects and strong competitive advantages and very high gross margins, we believe the stock is currently undervalued at ~3x EV/Future Revenue. While we wouldn’t put too much weight on EBITDA estimates at this stage, the stock also looks cheap at ~32x future EV/EBITDA, especially given that revenue and earnings are expected to continue to grow at a very fast pace for several more years.

By 2023, analysts expect revenue to reach nearly $250 million, which puts revenue/EV based on FY23 estimates at just ~2x.

Looking for Alpha

Looking at EPS estimates, as compiled by Seeking Alpha, estimates are for earnings per share of $0.14 by 2024, which would put the price/earnings ratio at ~29.9x . That might not sound like a bargain, but for a company that’s growing revenue at 77% annually and has plenty of room to expand EBITDA margins, we think it’s cheap.

Looking for Alpha

guidance

The company updated guidance for 3Q 2022 and full year 2022. For 3Q 2022 revenue is expected to be between $46 million and $48 million, and Rover expects adjusted EBITDA between $6 million and $8 million dollars For the full year 2022, Rover expects revenue of $160 million to $166 million, up 48% year-over-year at the midpoint of the forecast range, and adjusted EBITDA of $10 million to $14 million.

Both the low and high revenue guidance continue to take full-year impact related to Omicron and recent macroeconomic headwinds, including high cancellation rates and softer new customer demand, such as aligns with the macro slowdown seen in TSA and Google growth. volume of inquiries. The high end of the guidance differs from the low end in assuming more modest impacts from additional waves of Covid, and there is no incremental deterioration in demand due to macroeconomic trends.

During the earnings call, management reiterated its long-term margin target of more than 30% for the core business.

conclusion

We continue to believe that Rover is an attractive platform business that is growing at a fast pace and improving financials. The stock looks attractive on a number of valuation measures, including EV/Earnings Forward and EV to Annualized Gross Book Value. We believe that the company has competitive advantages, including the network effects of the two-sided market in which it operates, and based on proprietary data and algorithms is continuously improving to make better matches. Despite some disappointment with the reduction in guidance for the third quarter, and for the rest of the year, we still see a lot to like about the company.

[ad_2]

Source link