webguz

The NASDAQ 100 ETF (NASDAQ:QQQ) has seen an explosion in short hedging in recent weeks as funds de-risk their portfolios. It has sent the QQQ ETF up nearly 23% since its June 16 lows. This type of concentrations within secular bear markets are not that uncommon; during the 2000 and 2008 cycles, rallies of similar size or greater importance have occurred.

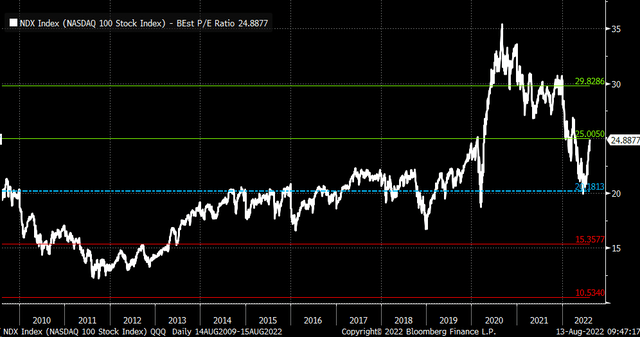

To make matters worse, the NASDAQ 100’s PE ratio has soared to levels that put the index back in expensive territory on a historical basis. That ratio is back to 24.9 times 2022 earnings estimates, which puts it back one standard deviation above its historical average since mid-2009 and the average of 20.2.

Bloomberg

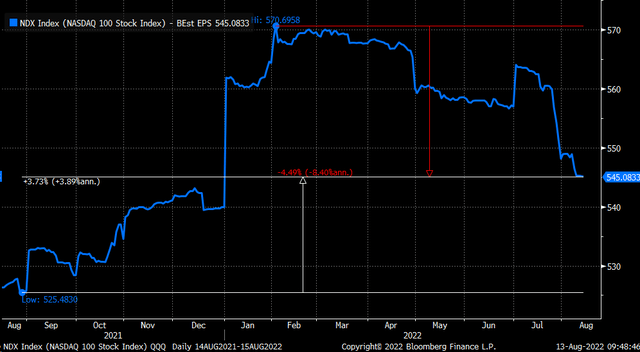

On top of that, earnings estimates for the NASDAQ 100 are down, falling about 4.5% from their high of $570.70 to about $545.08 a share. Meanwhile, the same estimates are up just 3.8% from this time a year ago. It means paying nearly 25 times earnings estimates is no bargain.

Bloomberg

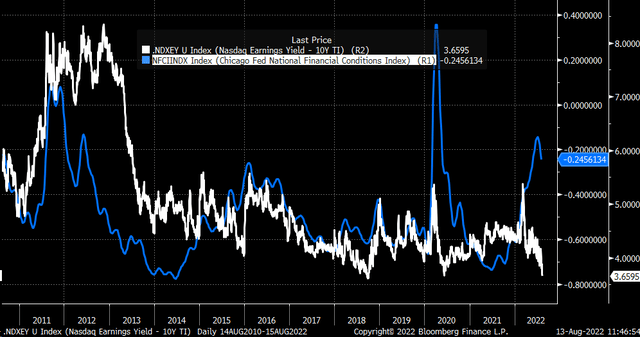

Real yields have soared, making the NASDAQ 100 even more expensive relative to bonds. The 10-year TIP is now trading around 35bp, up from -1.1% in August 2021. Meanwhile, the NASDAQ’s earnings yield is up around 4%, meaning the spread between actual returns and the earnings yield of the NASDAQ 100. has narrowed to just 3.65%. This spread between the NASDAQ 100 and real performance has narrowed to its lowest point since fall 2018.

Bloomberg

Financial conditions have eased

The reason the spread is contracting is that financial conditions are easing. As financial conditions tighten, the spread between stocks and real returns appears to narrow; when financial conditions tighten, it causes the spread to widen.

Bloomberg

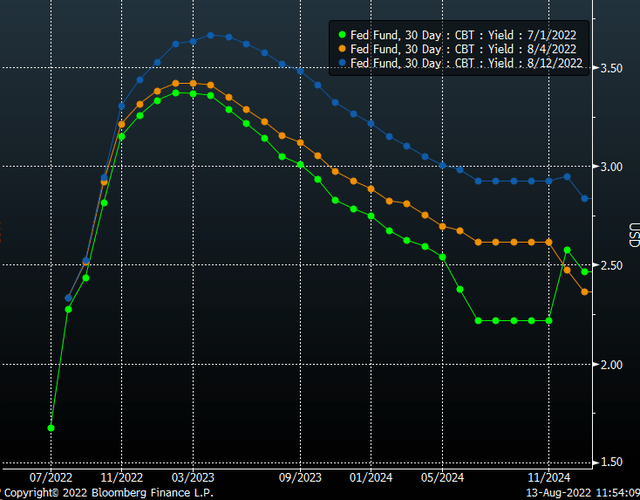

If financial conditions tighten further, there may be further multiple expansion. However, the Fed wants inflation rates to come down and is working hard to reshape the yield curve, and that work has started to show in Fed Fund futures, which are clearing the favorable pivot. Rates have increased dramatically, especially in the months and years after 2022.

Bloomberg

But more importantly, for this monetary policy to effectively impact the economy, the Fed needs financial conditions to tighten and be a restrictive force, which means that the Chicago Fed’s index of domestic financial conditions has of moving above zero. As financial conditions begin to tighten, the spread should increase again, leading to further multiple compression for the value of the NASDAQ 100 and causing the QQQ to decline. This could cause the NASDAQ 100’s PE ratio to fall to around 20. With this year’s earnings estimated at $570.70, the NASDAQ 100 would be worth 11,414, a decline of nearly 16%, which will send the QQQ back to $275 range. up to $280.

Not unusual activity

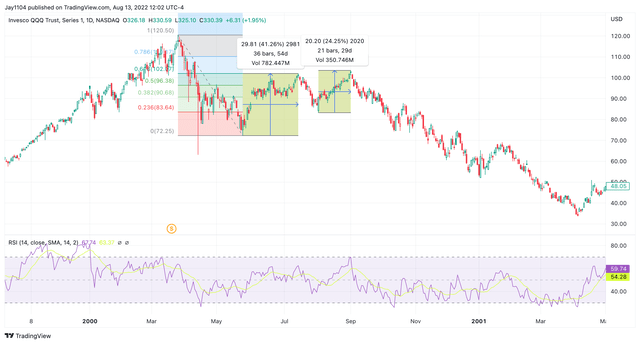

Also, what we see in the market is nothing new or unusual. It happened during the two most recent bear markets. The QQQ rose 41% from its intraday lows of May 24, 2000 to July 17, 2000. Then, just a couple of weeks later, it did it again, rising 24.25% from its intraday lows on August 3, 2000 through September 1, 2000. What followed was a very strong selloff.

TradingView

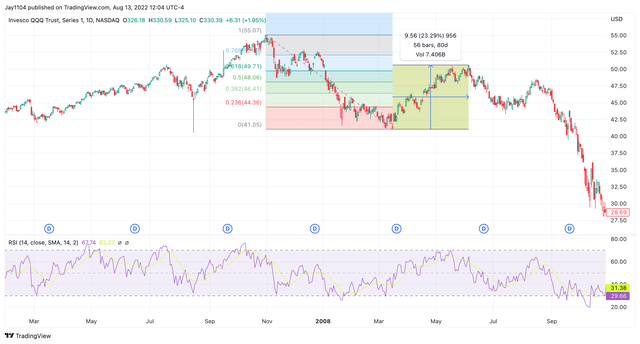

The same happened from March 17, 2008 to June 5, 2008, with the index rising by 23.3%. The point is that these sudden and forceful rallies are not unusual.

Commercial view

This rally has once again overvalued the index and ETF and recouped some of the more recent declines. It also put the spotlight back on financial conditions, which will need to be further tightened to start having the desired effect of slowing the economy and reducing the rate of inflation.

The upturn, while nice, is unlikely to last as the Fed’s monetary policy will need to be tighter to effectively return the inflation rate to the Fed’s 2% target, and that will mean spreads broad, lower multiples and slower growth. All bad news for stocks.

[ad_2]

Source link