Alena Kravchenko

There has been a sharp correction in the broader market over the past few months. Alphabet Inc. (NASDAQ: GOOG, NASDAQ: GOOGL) (“Google”) has proven to be a good bet in this scenario with solid fundamental growth metrics. In the last quarter, the the company reported the revenue of $69.7 billion versus the $69.9 billion expected. However, year-over-year revenue growth was 13%, which is a good figure considering the tough compensation and difficult macroeconomic situation. This growth rate is also higher than other Big Tech peers. It should be noted that the strengthening dollar further reduced the 3.7% revenue growth, according to Chief Financial Officer Ruth Porat.

Google is showing improvement in its hardware, subscription and cloud businesses. All of these companies can help the company have good growth in the coming years, even if we see a market correction or a brief downturn in the overall economy. Google also carried out massive share buybacks of $13.3 billion in the last quarter. Trailing twelve month share repurchases stood at $52 billion. This is enough to eliminate about 4% of outstanding shares annually. A modest P/E multiple, strong growth metrics and buybacks should boost Alphabet’s stock’s long-term return potential and make it a good bet in the current environment.

Continuation of the correction phase

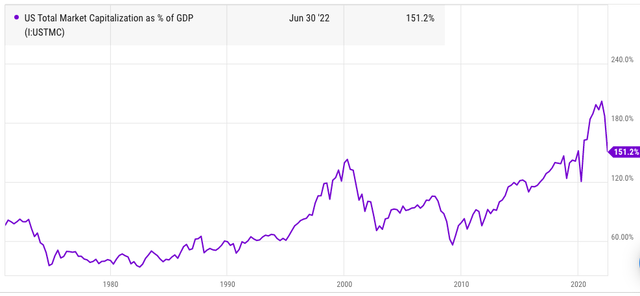

It is difficult to predict how long the current correction phase will continue. However, if geopolitical tensions continue, we could see a rise in commodity prices that may have a knock-on effect on inflation and lead to bearish sentiment on Wall Street. Even after the current correction, total US market cap as a % of GDP is quite high. We can look at the peak of the dot com bubble when this metric was below 140%. Currently, total US market capitalization as a % of GDP stands at 151%. If headwinds to the broader economy continue, we could see a continuation of the correction phase.

YCharts

Figure 1: US market capitalization as a percentage of GDP.

In this correction phase, it is important to have a portfolio that can withstand bearish sentiment and companies that can deliver sustainable growth.

Google is a strong growth story

Google has created a number of levers that should generate long-term growth. One of the main businesses is hardware. The company ranks second in smart speakers and smart home devices, behind Amazon ( AMZN ). It has also raised estimates for Pixel unit sales to 10 million this fiscal year. That’s well below Apple’s ( AAPL ) unit sales of more than 200 million iPhones. But Google has one of the best brand images among Android OEMs. The 5G era has also led to rapid average selling price growth for other Android OEMs due to higher costs. At the same time, Google is releasing budget Pixel phones with high specs that have narrowed the price gap with other manufacturers.

Pixel’s growth will also be supported by an increase in subscription business. Google has already launched Pixel Pass where customers can use all of the company’s subscription services along with a new Pixel device every two years. This spreads the cost of Pixel devices over a longer period and reduces sticker shock for customers. Google has reported more than 50 million subscribers on YouTube Premium and the YouTube Music platform. That number could rise quickly as the company ramps up benefits for subscribers while reducing options for non-subscribers.

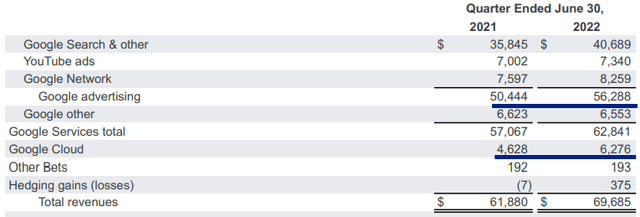

Company records

Figure 2: Strong growth in core advertising and Google Cloud.

Google Cloud is another major long-term bullish story for the company. Despite a slight slowdown, the company reported an annualized cloud service revenue rate of more than $25 billion with a 35% year-over-year growth rate. This service is still showing massive losses, but as revenue grows we should see better economies of scale.

If Google is able to close the margin gap with Amazon’s AWS, the cloud service will become one of the main drivers for margin expansion. At the current growth rate, the cloud service should reach the revenue rate of $100 billion by 2025. AWS has shown an operating margin of 30% for the past few quarters. If Google Cloud reports a modest 20% margin, it will add $20 billion to the company’s operating income by 2025.

Modestly priced shares

The main reason Google is a better bet to protect returns in a downturn is because of its cheap valuation multiple. Google has a higher year-over-year growth rate compared to other Big Tech peers and has a number of strong growth drivers. Despite these factors, it trades at a modest P/E multiple. The cheap valuation should allow the stock to recover more quickly in the event of a major downturn.

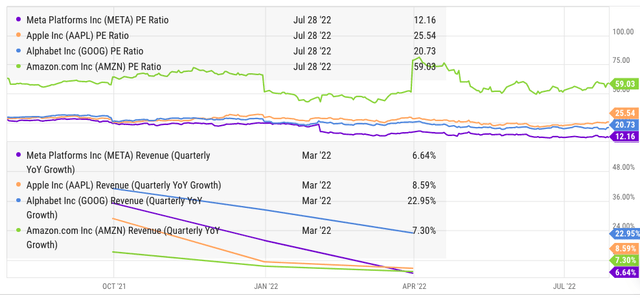

YCharts

Figure 3: Comparison of year-over-year revenue growth and P/E ratio of Big Tech companies.

Alphabet has been reporting better year-over-year revenue growth rates compared to other Big Tech companies in recent quarters. In the most recent quarter, Alphabet posted revenue growth of 13% year-over-year compared to Amazon’s 7%, Apple’s 2%, and Meta Platforms’ ( META ) negative 1%. At the same time, Alphabet’s P/E multiple is a modest 20.5 compared to Apple’s 25 and Amazon’s 60.

Alphabet’s management also spends heavily on buybacks. In the most recent quarter, the company bought back $13.3 billion worth of stock and over the past twelve months has bought back $52 billion worth of stock. Alphabet can continue and even increase the pace of buybacks because of its huge cash reserves and huge free cash flows. As the cloud service achieves economies of scale, we should see better margins in this segment. Most of those additional resources could be spent on buybacks, as the company doesn’t have many businesses that require large cash injections.

Investor to take away

The American stock market is going through a correction phase. This phase may continue for some time due to macroeconomic headwinds. Alphabet stock is a good bet because of its modest valuation multiple compared to other tech companies and prospects for future growth.

Google has already shown good progress in the hardware business where it is a leader in several categories. This will be a major driver of future revenue growth as new product lines are launched. Pixel sales are also improving, which should help the company’s subscription business and reduce the cost of acquiring traffic in the long run.

Margin expansion in the cloud business will be the main reason for better operating income and earnings in the coming years. Because of these factors, Alphabet stock looks like a better alternative compared to many other tech players.

[ad_2]

Source link