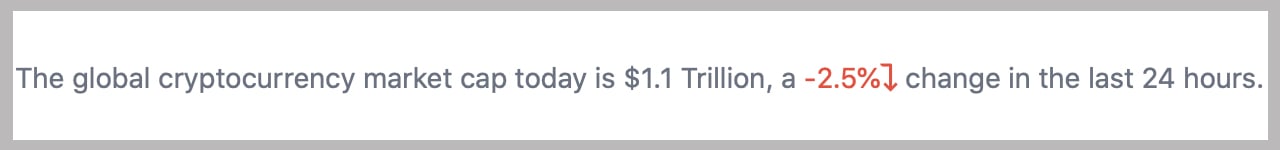

Stock and cryptocurrency markets saw volatility on Thursday, having seen fluctuations during tensions between China and Taiwan on Tuesday and Wednesday. Major indices such as the S&P 500, Dow Jones and NYSE dropped a few percentage points today, while the global cryptocurrency market cap lost 2.5% in 24 hours, falling to just above the range of 1.1 trillion dollars. Precious metals, on the other hand, traded higher when US President Joe Biden’s administration declared the monkeypox virus a public health emergency in the United States.

Tensions in China and Taiwan and Monkeypox reports cause stock and crypto prices to fluctuate, precious metals markets rise on ‘safe haven demand’

Stock and crypto traders faced some headwinds on August 4, the day after US Representative Nancy Pelosi of California visited Taiwan for to argue democracy with Taiwanese President Tsai Ing-wen. Global markets experienced some fluctuations before the US diplomat visited Taipei and also during Wednesday’s visit.

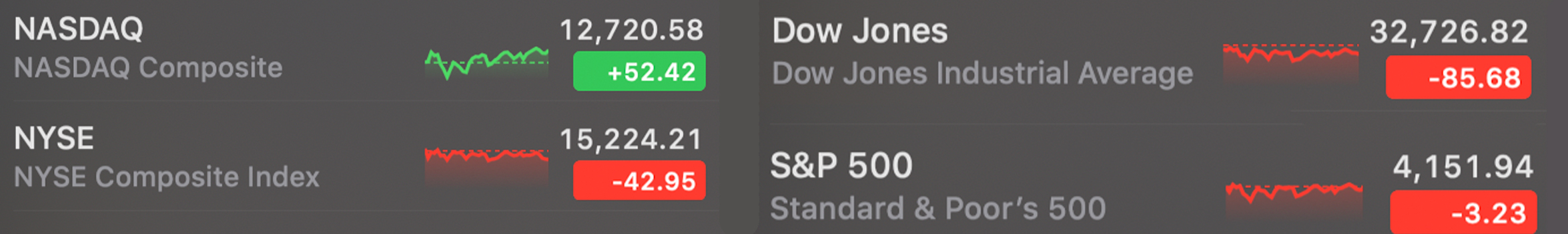

Equity and precious metals markets fell the day before on August 3, while the crypto economy managed to consolidate on another day. US equity markets took a bath again on Thursday, as the Dow Jones fell 85 points in afternoon (EST) trading. Cryptocurrencies followed the fall of the stock markets throughout the day.

Dow Jones Industrial Average Index on August 4, 2022.

Dow Jones Industrial Average Index on August 4, 2022.

While the Nasdaq rose, the S&P 500, NYSE and many other stocks saw losses in afternoon trading. The crypto economy also suffered losses, as all digital assets lost 2.5% in the last 24 hours against the US dollar.

The leading crypto asset bitcoin (BTC) it was down 5% late Thursday from $23,548 to $22,395. Ethereum (ETH) It also lost 5% today after hitting a 24-hour high at $1,666 per unit to a low of $1,545 per coin. Of the top ten crypto market cap competitors, solana (SOL) lost 5.6% more lost during the day and polka dots (DOT) down 5.5%.

BTC4-hour /USD chart on August 4, 2022.

BTC4-hour /USD chart on August 4, 2022.

In Europe, the war between Ukraine and Russia continues and tensions between China and Taiwan have risen this week. While Asia faces tensions, Europe faces an energy crisis and recession. The United States is also dealing with what many believe to be a recession despite claims to the contrary by American bureaucrats and their pundits.

Three of the four major indexes saw further losses on Thursday after a turbulent day earlier. The losses have been attributed to tensions between China and Taiwan, Monkeypox and the upcoming July jobs report.

Three of the four major indexes saw further losses on Thursday after a turbulent day earlier. The losses have been attributed to tensions between China and Taiwan, Monkeypox and the upcoming July jobs report.

On Thursday, the US Department of Labor published weekly jobless claims data, showing claims rose by 6,000 to 260,000. As the weekend approaches, stock traders have been interested in America’s July jobs report, due out on Friday. A couple of hours before the closing bell on Thursday, some of the main Wall Street indexes such as the Dow and the S&P 500 rallied slightly. At the close of trading on Wall Street on Thursday, three of the four major indexes were down.

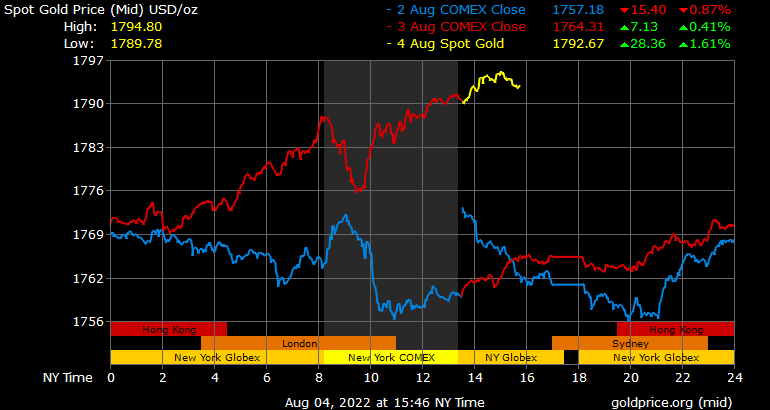

Gold price on August 4, 2022.

Gold price on August 4, 2022.

Meanwhile, gold and silver markets saw some relief on Thursday as both assets rose. The price of gold per ounce increased by 1.64%, while the value of silver per ounce against the US dollar increased by 1.04%. On August 4, Kitco’s Jim Wyckoff attributed Precious metals added to tensions in Asia as it said gold and silver prices were higher in the US due to “safe haven demand as China-Taiwan-U.S. tensions rose this week “.

Also on Thursday, reports detail that the United States has officially declared the Monkeypox virus a public health emergency. Washington Post (WP) reporter Dan Diamond explained that “two officials who spoke on condition of anonymity” said the Biden administration would declare monkeypox an outbreak and a public health emergency. Diamond wrote that the message would come from White House Health and Human Services Secretary Xavier Becerra.

After the report, Becerra ended up declaring monkeypox a public health emergency in the US during an afternoon press conference. “We are ready to take our response to the next level to address this virus and urge all Americans to take monkeypox seriously,” the health secretary. stressed out in the press

Tags in this story

Biden Administration Bitcoin BTC China Crypto Economy Crypto Markets DOW Stocks Stock Markets ETH Ethereum Gold Secretary of Health Jim Wyckoff Kitco Market Updates Monkeypox Nasdaq NYSE Health Emergency public, S&P 500, silver, Stock Markets, Taiwan, Ukraine-Russia War, Wall Street indices, War, White House, Xavier Becerra

What did you think of Thursday’s crypto and stock market action as gold and silver prices saw some gains? Let us know your thoughts on this topic in the comments section below.

![]()

Jamie Redman

Jamie Redman is the head of news for Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He is passionate about Bitcoin, open source code and decentralized applications. Since September 2015, Redman has written over 5,700 articles for Bitcoin.com News on the disruptive protocols emerging today.

Image credits: Shutterstock, Pixabay, Wiki Commons

Exemption from liability: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

More popular news

In case you missed it

[ad_2]

Source link