metamorworks/iStock via Getty Images

Introducing ExlService

ExlService (NASDAQ:EXLS), a business process management company, provides analytics and operations management services to clients. The company provides business process outsourcing, automation and data solutions to clients in diverse industries, including insurance, healthcare, utilities, banking and finance, travel and retail, among others. The The company operates in four segments: analytics, insurance, healthcare and emerging markets, depending on the areas it serves. The majority of the company’s sales are in the United States and more than half of the company’s revenue is derived from business process management and related services.

Sector perspectives

The field of business process management involves the use of various techniques to identify, model, analyze, measure, improve, optimize and automate business processes.

In the digital world these days, the development of intelligent business process management systems is aided by the adoption of artificial intelligence (AI) in various reputed companies. This is achieved by fusing AI with cloud capabilities, BPM (business process management) software and software solutions. Consequently, BPM platforms are always changing. As a result, it is also integrating a variety of enhanced processes, including the Internet of Things (IoT), business activity monitoring, cloud capabilities, message-oriented middleware, and others. For example, BPM systems with artificial intelligence are often used in the banking industry to streamline operations such as reporting, document generation, contract administration, and sales analytics.

These technologies could drive the future of business process management.

Seconds Fortune Business Insight ResearchThe business process management industry is projected to grow from $10.65 billion in 2020 to $26.18 billion in 2028, at a healthy CAGR of 12%

competition

There is intense competition in the market for data analytics and digital operations and solutions.

Accenture (ACN), Cognizant Technology Solutions (CTSH), Genpact (G), Infosys (INFY), NTT DATA (OTCPK:NTDTY) (OTCPK:NTTDF), Tata Consultancy Services and WNS (Holdings) (WNS) are some examples of large global companies with digital operations and solutions and operational capabilities that ExlService competes with. Other competitors include industry-specific digital operations and solutions providers such as Cotiviti and Optum Health.

Source: Morningstar and Seeking Alpha

Competitive position

According to the last annual reportExlService claims they compete for…

…working to differentiate itself as a strategic partner for companies with deep industry expertise, sophisticated data and analytics capabilities, innovative digital operations and solutions and technology, strong customer relationships, industry-leading talent, capabilities to superior processes and differentiated technology, which allow ExlService to respond quickly to market trends and the evolution of its customers’ needs.

ExlService operates a so-called vertical industry strategy. I’m a big fan of this approach as it allows for the aforementioned “industry expertise” that helps tailor solutions to maximize solution effectiveness and thus optimize customer satisfaction.

I think their previous differentiations in terms of data and analytics capabilities can be supported by the countless mentions from analysts.

For example, the company is called a 2022 Leader in Business Process Outsourcing in Finance and Accounting by Gartner. Gartner estimates that…

… by 2024, financial outsourcing of AI process technologies will increase from 6% to 40%, mainly focused on the digital transformation of transactional operations.

I believe this recognition demonstrates their strong offering of AI-enabled solutions.

Also, 2022 is called ExlService

In addition, users rate their products Gartner an impressive 4.9 out of 5 in the last 12 monthswhich is slightly higher than most of its other competitors.

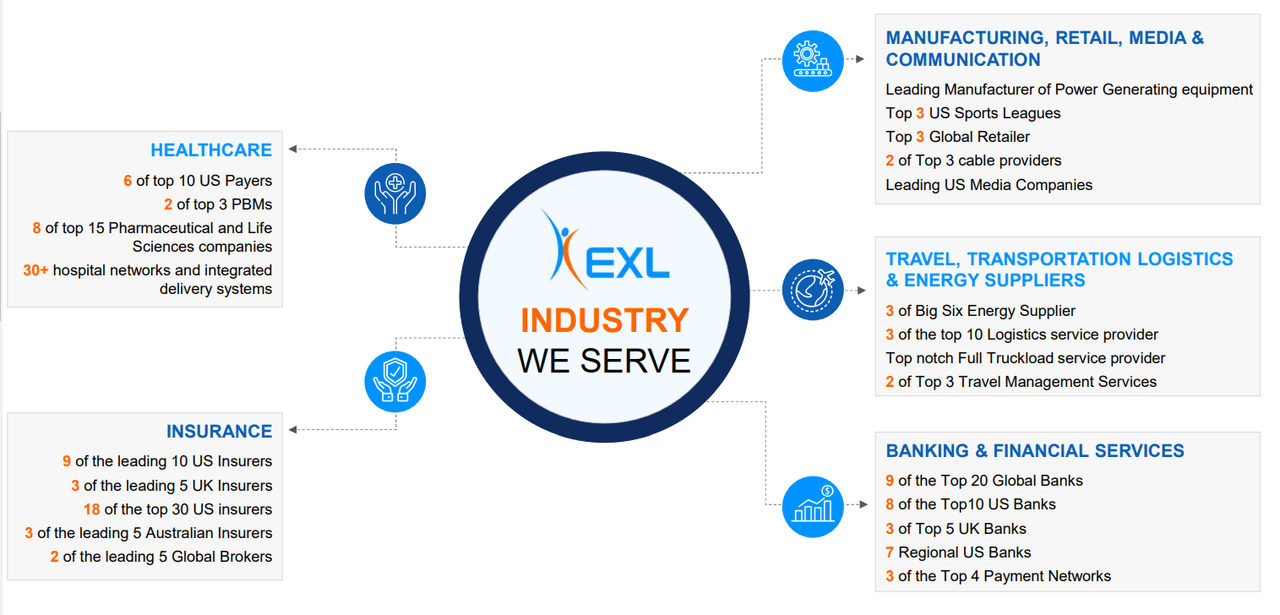

With their deep industry expertise, high user satisfaction and leadership position in their industries, they have built a respectable customer base across various industries.

Important Customers (RW Baird 2021 World Conference on Consumers, Technology and Services in 2021)

Despite intense competition from much larger companies, ExlService seems to have a strong position in its market due to its deep industry experience and very robust product offering.

The latest earnings report

On July 28, ExlService reported financial performance statistics that beat analysts’ estimates. The CEO said that…

…EXLS had a strong second quarter with revenue of $346.8 million, an increase of 26.1% over the second quarter of 2021. Analytics continued to lead our growth with a revenue increase of 44.8 % from the second quarter of 2021. Adjusted diluted earnings per share for the quarter was $1.50, up 31.6% year-over-year. Our focus on data-driven solutions that leverage domain expertise, artificial intelligence and digital capabilities is resonating with customers and driving significant growth. Our value proposition to help our clients improve their growth and profitability remains relevant throughout the business cycle. The market for our services remains strong as we look towards the second half of 2022.

In my opinion, these statistics prove their current strong offering.

The stock price rose 17% in the past 5 days on the back of the earnings numbers.

Valuation and financial performance

Basic Stats Comparison:

Source: Seeking Alpha

ExlService is the most expensive company in the competitor group. In addition, its revenue growth is unusual, its free cash flow margin is slightly lower than other companies, and its debt to equity is higher.

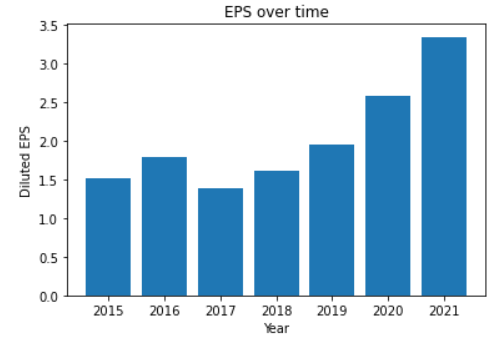

One thing the company has going for it is its very high 3-year EPS growth rate of 27%. In addition, the stock has the highest gross margin in the group.

A closer look at its EPS over time since 2015:

EPS Growth (Seeking Alpha data, chart by author)

This translates to a very healthy CAGR of 12% since 2015. I don’t think it’s realistic to use the historical 3-year EPS growth rate of 27% for the following years. However, I think something around 12 to 16 percent per annum would be more appropriate.

final take

I think ExlService offers a very solid offering and that’s why it’s liked by many reputable customers and analysts. As a result, they have historically shown great growth rates. The latest earnings performance was so good it sent the stock price up 17%. Because of this, the rating is now slightly higher than its competitors. However, I still think there is a buying opportunity here. ExlService is only a fraction of the size of other competitors, and with its earnings growth momentum, I believe its earnings growth can continue to outpace its peers, albeit less than its historical growth of EPS of 3 years.

[ad_2]

Source link