Sales of international renminbi bonds have surged this year as the country’s fixed-income investors, lacking decent returns at home, take advantage of new market access to higher-yielding Chinese currency debt abroad.

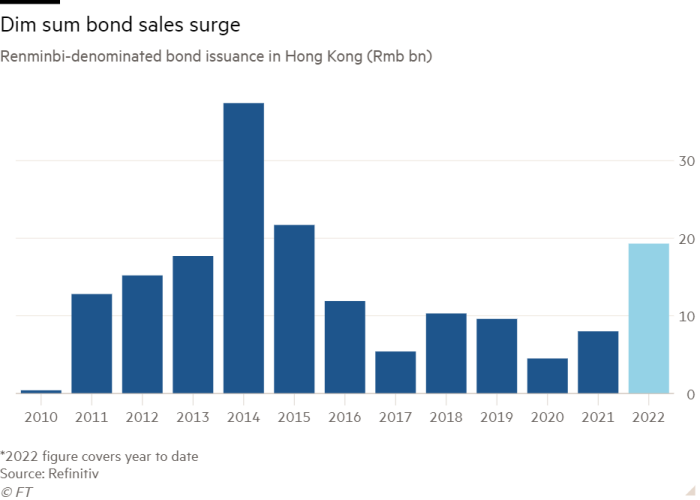

The volume of dim sum bond deals (renminbi-denominated debt sold in Hong Kong) rose 145 percent from a year ago to Rmb126.8 billion ($19.3 billion), already surpassing the total of the year 2021, according to data from Refinitiv. That puts the market on track for its best year since 2016.

The revival of Hong Kong’s long-stagnant dim sum market contrasts with China’s negative market sentiment toward onshore renminbi debt, which foreign investors have been pouring at a record pace into ‘a higher yielding dollar debt.

“The collection in issue [of dim sum bonds] it’s real,” said Becky Liu, head of China macro strategy at Standard Chartered.

On the demand side, Liu said mainland Chinese investors were taking advantage of the Southbound Bond Connect scheme, which was launched late last year and allows China’s domestic financial institutions to access bonds traded in Hong Kong.

That includes dim sum bills, which offer a yield premium compared to China’s domestic fixed-income market, where easing measures to combat an economic slowdown have depressed bond yields.

And while international investors swap their holdings of renminbi bonds for dollar debt, China’s capital controls leave its domestic bond traders with far fewer options, making the dim sum market an attractive source of higher returns juicy

Meanwhile, a series of sharp rate hikes by the US Federal Reserve have pushed yields on dollar bonds higher than equivalent dim sum debt, encouraging more foreign financial groups to raise renminbi funds in Hong Kong that can be used for commercial financing and other purposes.

“One of the previous obstacles to getting renminbi for invoicing to support trade finance and other uses was high interest rates, but that story has changed: the cost of financing in renminbi is cheaper than the dollar,” he said. said Liu.

This increase in overseas renminbi fundraising is also accompanied by signs of an increase in renminbi-denominated trade deals. In June, India’s largest cement producer UltraTech adopted China’s currency to pay for Russian coal imports.

“The dollar remains the dominant currency in global trade, but we have a number of examples pointing to a potential increase in renminbi-denominated trade settlement,” Liu said.

And while the majority of dim sum bond sales this year have come from the international branches of China’s biggest banks and financial institutions, Refinitiv data shows that foreign issuers account for about a fifth of total proceeds from background

Policy banks from countries such as Germany, South Korea and Sweden, as well as the World Bank, have tapped into the market this year, as have lenders to commodity exporters in China such as National Australia Bank and Maybank of malaysia A handful of companies have sold dim sum bonds, including Hong Kong property group Wheelock.

China’s finance ministry has also signaled high-level support for the market’s growth with the sale of Rmb7.5 billion in offshore bonds in three tranches last month and has announced plans to tap the market for a record fourth time in end of the year

Investors said the Southbound Bond Connect program had also sparked more interest among Chinese issuers to sell offshore renminbi debt, with property developer China Vanke raising Rmb500m from a dim sum deal last month.

“Mainland companies that issue offshore bonds on a regular basis now find it cheaper to issue dim sum bonds than dollar bonds,” said a senior fixed income investment manager with a Shanghai-based foreign lender. “And it’s natural for [Chinese] investors to seek higher yielding assets in offshore markets.”

But he added that Chinese financial institutions were still required to flag any planned bond purchases or sales with the country’s central bank and foreign exchange regulator days in advance. The precautions are part of a regulatory hangover from 2016, when a rout of the renminbi forced Beijing to impose strict capital controls.

“The outflows are still closely watched by the PBoC and the State Administration of Foreign Exchange,” the investment manager said, referring to the central bank, the People’s Bank of China. “They don’t want any additional volatility.”

[ad_2]

Source link