In a letter addressed to CEOs of financial institutions, the Central Bank of Kenya (CBK) has said that financial institutions operating in the country must cease and desist from dealing with two Nigerian fintechs, Flutterwave and Chipper Cash. The letter reiterates claims by CBK Governor Patrick Njoroge and the Asset Recovery Agency (ARA) that the two companies are not licensed to operate in Kenya.

Flutterwave and Chipper’s clash with the CBK

The Central Bank of Kenya (CBK) has ordered the country’s financial institutions to cease and desist from dealing with two Nigerian fintech startups Flutterwave and Chipper Cash. The order came barely 24 hours after CBK Governor Patrick Njoroge had he said journalists that the two entities are not licensed to operate in Kenya.

Prior to the CBK’s announcement, a Kenyan High Court had ruled that Flutterwave’s bank accounts be frozen to pave the way for an investigation into the fintech giant’s alleged illegal activities. The court ruling later allowed Kenya’s Asset Recovery Agency (ARA) to block Flutterwave’s access to more than 50 bank accounts that reportedly hold close to $60 million.

As previously reported by Bitcoin.com News, the ARA has argued that Flutterwave does not provide commercial services as claimed, but is instead engaged in money laundering activities. However, Flutterwave dismissed the allegations and claimed to “have the records to verify it.” The fintech unicorn, which raised $250 million earlier this year, also said it “maintains the highest regulatory standards in our operations.”

Additionally, the fintech company’s statement stated that its “anti-money laundering practices and operations are regularly audited by one of the Big Four.”

CEOs of financial institutions said to confirm their compliance

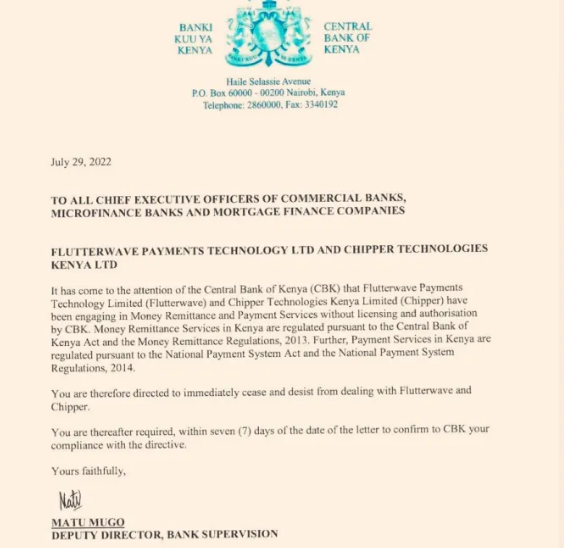

While Flutterwave suggested in its statement that it is working with regulators, Njoroge’s remarks and the CBK’s subsequent letter to CEOs of Kenyan financial institutions dated July 29 reiterate the ARA’s allegations that Flutterwave engages in “unlicensed and unauthorised money remittance and payment services”.

Meanwhile, in addition to informing the heads of Kenyan financial institutions about the operating license status of the two fintechs, the letter also requires the CEOs to confirm compliance with the order within seven days

“Therefore, you are requested to immediately cease and desist from dealing with Flutterwave and Chipper. You are then requested to confirm to CBK your compliance with the directive within seven days of the date of the letter,” says the CBK letter.

Register your email here to get a weekly update of African news delivered to your inbox:

What do you think about this story? Let us know what you think in the comments section below.

![]()

Terence Zimwara

Terence Zimwara is an award-winning journalist, author and writer from Zimbabwe. He has written extensively about the economic problems of some African countries, as well as how digital currencies can offer Africans an escape route.

Image credits: Shutterstock, Pixabay, Wiki Commons

Exemption from liability: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

More popular news

In case you missed it

[ad_2]

Source link