Leon Neal

Thesis

European oil and gas companies trade at incredibly attractive valuations, even if investors adjust the companies’ profitability according to falling oil and energy prices.

A name I particularly like is BP (NYSE: BP), like me We believe the company has struck a reasonable balance between picking up its legacy oil and gas business, while investing in new renewable energy sources.

Against the background of high energy prices, BP strongly outperformed the market. BP shares are up more than 8% YTD compared to a loss of almost 15% for the SPX. Will the outperformance continue? Hard to say. But based on fundamental analysis, BP shares are still cheap, especially when compared to their US peers. Based on a residual earnings valuation model, I calculate almost 80% upside.

Looking for Alpha

About BP

Beyond Petroleum, formerly known as British Petroleum, is an integrated energy business based in the United Kingdom. BP has been a leader in the oil and gas industry for over 110 years and today the company produces nearly 2 million barrels of oil equivalent. As of 2022, BP claims proven hydrocarbon reserves equal to 16,954 mmboe and 4.4 GW of capacity from developed renewables.

The group operates three key segments: (1) Production and Operations, (2) Customers and Products and (3) Gas and Low Carbon Energy. BP production and operation segment. The production and operation business focuses on (upstream) fossil fuel exploration and extraction. The customer and product business is the business (downstream) marketing segment, focused on offering connected solutions for gasoline, electric vehicle charging, but also refining and trading. Finally, the group’s low-carbon energy solutions focus on the development of decarbonisation technologies and, according to the company: “Potential moves to new value chains such as hydrogen and carbon capture and storage”.

In particular, BP has been one of the first oil and gas companies to aggressively push towards net zero and invest in sustainable energy sources. In 2020, the group made headlines by publishing: Peak oil demand and long-term oil prices:

The prospect of peak oil demand, combined with an increasingly abundant supply of oil, has led many commentators to conclude that oil prices are likely to fall inextricably over time. If demand for oil is drying up and the world is full of oil, why should oil prices be significantly higher than the cost of extracting the marginal barrel?

Extremely bullish fundamentals

Two years after BP’s “Peak Oil” paper, energy prices have skyrocketed and culminated in an energy crisis. As a result, BP’s profits shot through the roof.

In the trailing twelve months, BP generated revenue of $201 billion, nearly double 2020 revenue ($105 billion). Respectively, operating income rose from a loss of $22.1 billion in 2020 to a profit of $26.2 billion for TTM. Cash provided by operations increased to $31.2 billion.

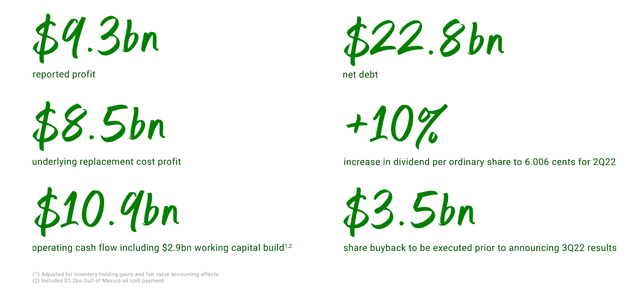

On August 2, BP released the results for the quarter of June 2022 and delivered explosive results: the group reported profits for the quarter of $9.3 billion. Operating cash flow was $10.9 billion. BP’s strong performance was driven by (up) oil production and refining.

Against the backdrop of such a stellar quarter, BP increased its quarterly dividend by 10% to 6.006 cents per ordinary share. and said:

This increase reflects the underlying performance and cash generation of the business, which has enabled strong progress in share buybacks and net debt reduction.

The company did $2.3 billion in share repurchases during the quarter.

BP Q2 results

Rated cheap

Personally, I see a downside for energy prices and $60 per barrel could be likely by the end of the year. But I still think BP is cheaply valued. Investors should note that at $60/barrel, BP generates sufficient cash flow to support the current dividend payout and grow by 4% per year.

Looking ahead, on average, based on BP’s current forecasts, bp continues to expect to have capacity for an annual dividend increase per ordinary share of around 4% through 2025 to around $60 per Brent barrel and subject to the discretion of the board each quarter.

At $40 a barrel, BP would operate cash neutral. According to the company:

It is supported by a 2021-5 average cash balance point of around $40/bbl Brent, $11/bbl RMM and $3/mmBtu Henry Hub (all 2020 real).

Investors should consider BP’s valuation multiple compared to its US parent. For reference, BP trades at a one-year forward P/E of x3.5, an EV/Revenue of x0.54 and a P/B of about x1. XOM trades at a forward one-year P/E of approximately x7, an EV/Revenue of x0.95, and a P/B of approximately x2. Likewise, Chevron (CVX), currently trades at a non-GAAP P/E of approximately x14. This is roughly a 100% premium, despite European and US oil producers sharing equally in windfalls/contractions driven by oil price volatility.

Valuation of residual earnings

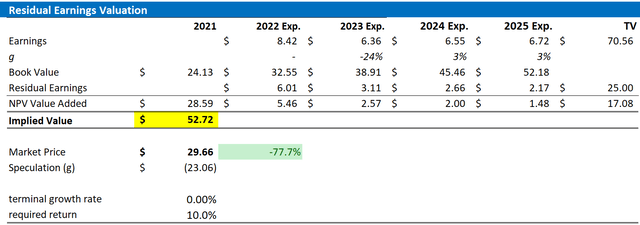

Now let’s look at the rating. What might be a fair value per share for the company’s stock? To answer the question, I have constructed a residual earnings framework and based it on the following assumptions:

To forecast EPS, I’m anchored by consensus analyst forecasts available on the Bloomberg terminal through 2025. In my view, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, the analyst consensus is usually pretty accurate. To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the FTSE 100 to find the stock’s beta. For the risk-free rate, I used the 10-year US Treasury yield as of August 2, 2022. My calculation indicates a fair required return of 9%. To get BP’s tax rate, I extrapolate the 3-year average effective tax rate of 2019, 2020, and 2021. For the terminal growth rate, I apply 0 percentage points to reflect the balance of a secular decline for the business of oil and gas and the transition to green energy.

Based on the above assumptions, my calculation returns a base case target price for BP of $52.72/share, implying a material upside of nearly 80%.

analyst consensus; author’s calculation

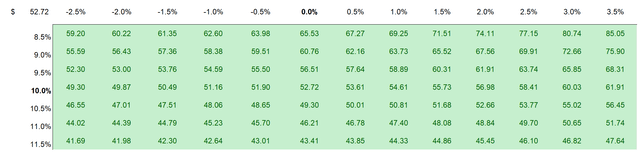

I understand that investors may have different assumptions regarding BP’s required performance and terminal business growth. Therefore, I also attach a sensitivity table to test different assumptions. For reference, red cells imply overvaluation compared to the current market price, and green cells imply undervaluation.

analyst consensus; author’s calculation

Risks for my thesis

My thesis is related to the implication that there are no structural differences between European and North American oil majors. This, however, is not necessarily true as the respective regulatory exposure is somewhat different. Arguably, the European Union is a bit more aggressive in its push for green energy, and US stocks generally trade at a premium. However, a relative valuation discrepancy of 100% is not justified in my opinion. Also, investors should note that I assume a sustainable oil price of around $60/barrel. While this may sound bearish to some readers, others might argue that the fair value of oil is much lower. As the 2020 COVID-19-induced sell-off has shown, oil can even trade at negative price levels. If oil were to break significantly below $60 a share and not recover in a reasonable amount of time, BP’s bullish thesis would be shattered.

conclusion

While I recognize that oil price risk is skewed to the downside, BP is trading too cheap to ignore. In particular, investors can enjoy a premium of 70% to 100% for US peers. Is this justified? I do not think so. I value BP based on a residual earnings framework, anchored by analyst EPS consensus, and see almost 80% upside. My target price is $52.72/share.

My articles on other European oil majors:

TotalEnergies – Totally undervalued compared to US peers Equinor – Fundamentals and relative valuation indicate significant upside

[ad_2]

Source link