Goodbye July, it’s been a pleasure. Sentiment may finally be turning on Wall Street after the stock market posted its best month since November 2020, boosted by better-than-expected quarterly results from tech giants and the prospect of the Fed tapering future rate hikes .

The major indexes are still down for the year, but we are clearly in the middle of a rebound.

Where this rally will go is anyone’s guess. For now, Wall Street analysts are busy picking the stocks they think are best positioned for gains over the remainder of 2H22. These “Top Picks” are an interesting group of buying stocks with strong upside for all.

Does that make them the right stocks for a confusing time? We can take a look at the latest details, taken from the TipRanks database, and check out recent analyst comments to find out. Each of these three stocks has received a “Top Pick” designation in recent weeks.

TechnipFMC Plc (FTI)

First on our list is TechnipFMC, a technology provider in the energy sector, serving both traditional producers and new energy customers. TechnipFMC offers a wide range of fully integrated projects, products and services, ranging from onshore hydrocarbon exploration and extraction to offshore rigs and platforms to oil refining. The company operates a fleet of 18 technically advanced industrial ocean vessels, has an active presence in 41 countries and achieved revenues of $6.4 billion in 2021.

A look at TechnipFMC’s revenue over the past two years shows a sharp drop from 4Q20 to 1Q21, but that’s an artifact of spinning off its petrochemicals and LNG businesses into a separate company. Since the spin-off, revenue has remained flat between $1.53 billion and $1.68 billion. Until the last second quarter.

For 2Q22, the company announced a top line of $1.72 billion, a 10% sequential jump from 1Q22 and a more modest 3% year-over-year gain. The increase in revenue was driven by solid gains in the two main areas of the business, including a 9.7% sequential gain in Subsea revenue and a 13% sequential gain in the Surface Technologies segment.

The story continues

Solid performance allowed the company to make capital structure improvements, including a $530 million reduction in total debt, which now stands at $1.5 billion. The company claimed $684.9 million in cash and liquid assets at the end of the quarter. In addition to improving the balance sheet, the company also announced a share repurchase authorization of $400 million, which translates into 15% of the total shares outstanding. The authorization marks the beginning of a policy of capital return to shareholders.

In Piper Sandler coverage, analyst Ian Macpherson points to increased momentum in Subsea as a forward-looking driver for FTI shares, writing: “After booking $1.9 million in the first quarter, we assumed an average inflow of $1.6 million for the second quarter of the quarter and we wouldn’t. It’s surprising to see our annual estimate of $6.7 million eclipsed. The volume of work that FTI doesn’t tender this year is unprecedented in the past decade. That in itself is a strong indicator of pricing power finally normalizing back to sustainable levels. This cyclical tailwind, when combined with margin leverage embedded coupled with the relentless innovation of FTI’s business model over the last 5 and last 1-2 years, suggests a reasonable upside for the recently outlined Subsea margin roadmap…

Believing that this company will outperform and that bookings and business will increase, Macpherson maintains it as a “Top Pick” and rates the stock as Overweight (a buy). Its price target, at US$14.65, suggests a one-year upside of 81% next year. (For Macpherson’s history, click here.)

This energy industry support cast player has 4 recent analyst comments on record, and they are unanimous that this is a buy stock, supporting a consensus rating of Strong Buy. The stock is trading at $8.09 and its average price target of $11.91 implies a 47% year-to-date gain. (Check out the TechnipFMC stock forecast on TipRanks.)

Legend Biotech Corporation (LEGACY)

Next on our list is Legend Biotech. This clinical-stage biopharmaceutical company works on advanced cell therapies for the treatment of hematological and solid tumor cancers. This is a common path for biopharmaceutical companies; Legend is differentiated by the advanced nature of its pipeline program, which currently includes several Phase 2 and Phase 3 clinical trials. The company’s hematologic malignancy program is the most advanced, with no less than 6 ongoing late-phase trials .

In its clinical program, Legend made several important announcements last June. The first of these announcements concerns a new program, LB1908, for which the FDA has just cleared an Investigational New Drug (IND) application, paving the way for a Phase 1 clinical trial of LB1908 in the US. The drug candidate is a CAR-T therapy designed to target relapsed or refractory gastric, esophageal and pancreatic solid tumor cancers. A phase 1 trial of this drug candidate is already underway in China.

In the second announcement, Legend released new data from its ongoing CARTITUDE large-scale clinical trial program for ciltacabtagene autoleucel. This is a new treatment for the dangerous blood cancer multiple myeloma, which has no effective treatments and unmet medical needs. New data show “profound and durable” therapeutic responses among patients in multiple CARTITUDE trials, with an overall response rate of 98% after two years.

The most exciting development, however, was the February FDA approval of Carvykti, one of Legend’s new treatments for multiple myeloma. The FDA’s move was followed in May by the European Commission’s approval to begin marketing activities. Carvykti is a genetically modified autologous T-cell immunotherapy directed by BCMA, also called cilta-cel. Legend has an exclusive global license agreement with Janssen for the commercialization of Carvykti.

In addition to these clinical updates, Legend reported significant financial results during the first quarter. These include revenue of $40.8 million, derived from development milestones in licensed research programs. Legend also has $796 million in cash and cash equivalents on hand, compared to Q1 R&D and G&A expenses of $94 million, giving the company a cash runway until 2024.

All of that was enough for BMO analyst Kostas Biliouris to make Legend one of his top picks in the biotech sector and set an outperform (buy) rating on the stock. His price target of $77 implies a one-year upside of 63%.

Supporting his position, Biliouris points to several strengths of this company: “1) The commercialization of Carvykti in multiple myeloma (MM) as a best-in-class late-line CAR T therapy expected to confer a significant revenue stream, providing downside protection; (2) Continued expansion of Carvykti’s addressable population through approvals in previous lines and legacy US regions will drive additional growth, driving long-term value; (3) Upcoming data readings from previous line therapies may increase in the near term; and (4) Diversified pipeline offers optionality and opportunities for better scale-up.” (To see Biliouris’ record, click here.)

Once again, we’re looking at a stock with a unanimous consensus rating of Strong Buy; Legend received 4 positive analyst reviews recently. Shares of LEGN have an average target price of $72, indicating a 52% upside from the current trading price of $47.24. (Check out Legend’s stock forecast on TipRanks.)

AvePoint (AVPT)

The last stock we’ll look at here is AvePoint, one of the major players in the software industry. The company offers a cloud-based SaaS platform that provides solutions for data migration, management and protection alongside Microsoft 365. The New Jersey-based company was founded in 2001 and has adapted that the IT environment has changed over the years, expanding its range of products and software solutions.

Running some numbers, AvePoint boasts of managing over 125 petabytes of data and that its most recent quarter, 1Q22, saw 45% SaaS revenue growth and annualized recurring revenue (ARR) growth of 30%, to a total of 167.4 million dollars.

The increase in the company’s SaaS revenue brought this segment’s total to $26.6 million in the first quarter, out of a total of $50.3 million on the top line. While revenue rose, profits were negative, with a diluted EPS loss of 6 cents, although that compared favorably to the year-ago quarter, when the EPS loss stood at in 14 cents. AvePoint has a strong cash holding, with $260 million in cash and short-term investments available.

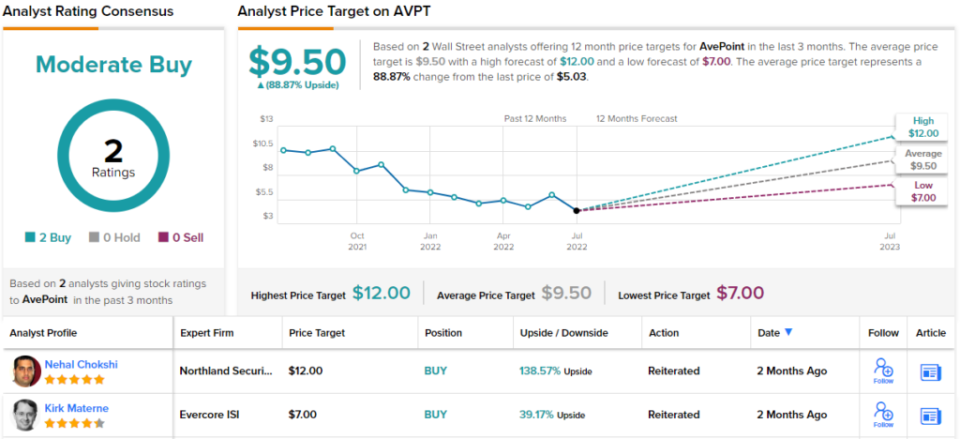

5-star analyst Nehal Chokshi of Northland Capital Markets selected this stock as a Top Pick after a deep dive into the company’s performance. He is impressed by AvePoint’s forward potential, writing: “We see our new long-term revenue CAGR of 25% to be very conservative given that our early stage work highlights a highly differentiated capability relative to the co-op player main MSFT and that our work verifying AVPT is addressing the full $6.5M TAM identified… Other key parameters of our DCF include a non-GAAP OM of 30%, which is 500bp above the low end of management’s 25+% guidance, but consistent with the 30%+ terminal OM we assume with other high-quality SaaS names under coverage…”

These comments support Chokshi’s Outperform (Buy) rating, while his $12 price target implies a 138% upside over the next 12 months. (To see Chokshi’s record, click here.)

The two recent analyst reviews on this stock are positive, leading to a unanimous Moderate Buy consensus rating. The stock is trading at $5.03, and its average price target of $9.50 suggests an 89% upside this year. (Check out AvePoint’s stock forecast on TipRanks.)

For great ideas for trading stocks with attractive valuations, visit TipRanks’ The best stocks to buya newly launched tool that brings together all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

[ad_2]

Source link