Danai Jetawattana/iStock via Getty Images

My last article on the inventory cycle was published on 5/18/2021. At the time, the economy was strong and the business cycle was on the rise. At that time, the dynamics of the inventory cycle correctly pointed to the following takeaway food:

The relationship between inventories and sales pointed to continued strength in manufacturing; raw materials and interest rates to rise; commodities and interest rates peaked as the inventory-to-sales ratio began to rise; CAT and FCX to outperform the market.

The inventory cycle continued to support the previous findings. Now, however, important changes have taken place. let me explain

Peter Dag’s strategy and portfolio management

The economic cycle goes through four main phases. Each phase has important implications for investment trends and is driven by how business leaders react to economic conditions.

In Phase 1, the company experiences low inventories and stronger demand. Consumer optimism is rising as post-inflation incomes improve thanks to lower inflation and interest rates. The company responds to the increase in sales by increasing production targets and building up inventories.

Increased production means more demand for raw materials and employment, and increased borrowing to improve and increase capacity. The result is lower commodities and lower interest rates, and employment increases in this phase.

The positive loop of more income, more sales, more employment, more output takes the business cycle into Phase 2. This is when the economy strengthens above its historical average rate. Production is now rising rapidly, putting upward pressure on raw materials, wages, interest rates, and general inflation. Labor costs rise with inflation. Consumer optimism (Univ. of Michigan) declines due to decline in purchasing power caused by rising inflation.

Towards the end of Phase 2, these trends become a worrying development. The economy is overheating and rising inflation is causing a slowdown in real demand. The economy now enters phase 3.

In Phase 3, companies do not recognize that consumers’ purchasing power is declining. Manufacturers continue to produce to keep unit costs low and plants run at full capacity.

There is a time in Phase 3, however, when sales grow at a slower rate than inventories, causing costs to rise more than expected, negatively impacting earnings. The company then decides to cut production to protect revenue. The result is decreases in raw material orders, decreases in debt and layoffs. Inflation, however, continues to rise, further reducing consumer purchasing power.

The business cycle is now in phase 4, the most important phase for investors because of the risk of large declines in stock prices. This is the time when large-scale bear markets develop and all the excesses created in the previous phases are eliminated.

The economic cycle is in Phase 4. It will last while:

The growth of stocks decreases and aligns with that of sales. Stock growth will need to slow to 3% after inflation based on recent history. Commodities and interest rates are falling as companies cut back on commodity purchases and borrowing as they try to trim inventory growth. Inflation and labor costs eventually decline. This is a major development accompanied by growing consumer optimism due to increased purchasing power and improved earnings.

The economic cycle will move to Phase 1 following previous developments.

BLS

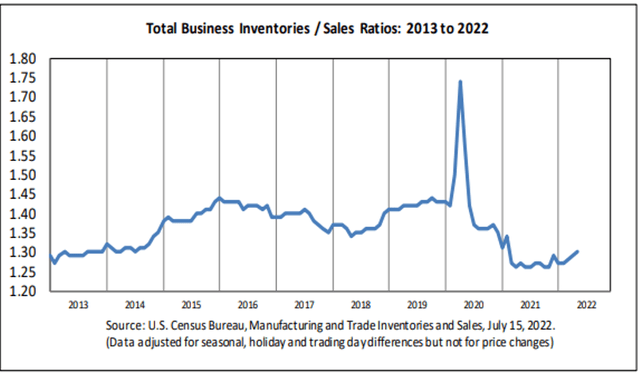

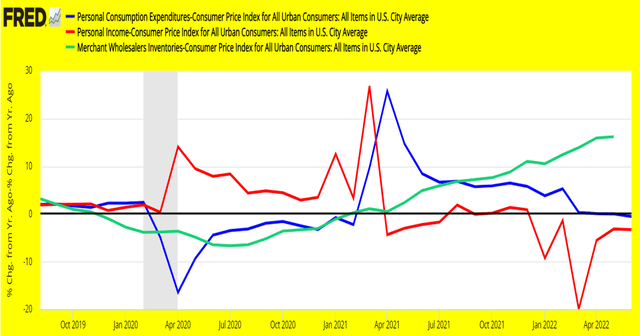

The chart above shows the inventory/sales ratio as of May 2022 (published on July 15, 2022 by the Bureau of Labor Statistics). The ratio is rising, reflecting inventories growing faster than sales. At the time of writing, for example, wholesaler inventories are soaring at a +16.2% year-over-year rate after inflation. Retail sales after inflation, meanwhile, decreased by -0.6% year-on-year, and personal incomes fell -3.3% year-on-year after inflation.

Peter Dag’s strategy and portfolio management

Inventories will be reduced aggressively because they impact earnings in a major way. Production will be reduced enough to bring inventory growth in the 2% to 4% range after inflation.

Peter Dag’s strategy and portfolio management

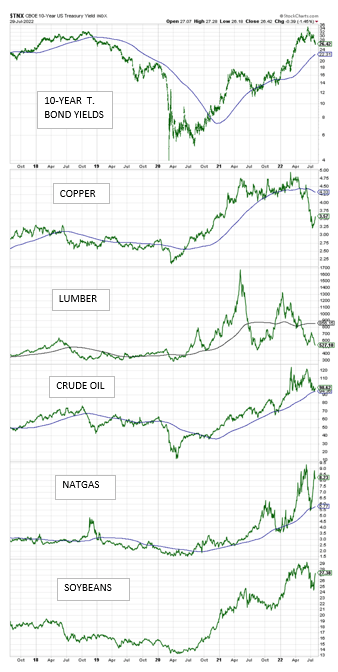

Meanwhile, commodities and long-term interest rates will continue to fall to reflect lower growth in business activity caused by declining production and inventories (see chart above).

Peter Dag’s strategy and portfolio management

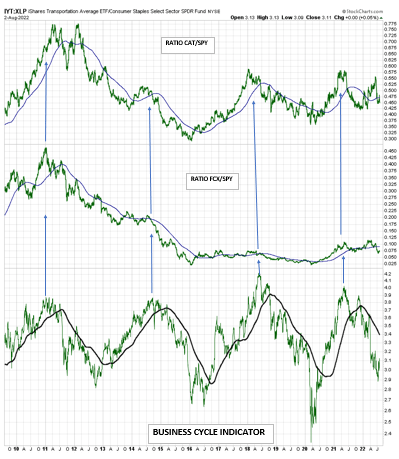

As suggested in the article mentioned above, Caterpillar (CAT) and Freeport-McMoRan (FCX) are likely to outperform the market in a rising business cycle, as reflected by the rising CAT/SPY and FCX/SPY ratio (see the previous panels).

However, now that the inventory correction is forcing the business cycle down (see the bottom panel of the chart above), CAT and FCX are likely to underperform the market: the CAT/SPY and FCX/SPY ratios are declining . This underperformance will continue as long as the economic cycle is down.

key food

The business cycle is in phase 4. Inventory growth remains excessive and should be reduced to low single-digit growth after inflation. The inventory slowdown will be accompanied by lower stock prices ( SPY ), lower commodities, lower yields, lower growth in output, employment and overall business activity. The process will continue until inflation begins to decline convincingly, enough to improve consumer optimism. Labor costs will also decrease, improving earnings prospects. This is when the stock market (SPY) bottoms out and stocks like Caterpillar and Freeport-McMoRan start to outperform the market (SPY) again.

[ad_2]

Source link