The latest Fitch Ratings Macroprudential Indicators (MPI) scores suggest that the number of countries vulnerable to banking sector stress remains low by historical standards. However, global monetary tightening will be a test of any macroprudential vulnerabilities that have built up over the long period of very low interest rates.

Fitch’s IPM ratings are intended to identify potential stresses in banking systems and the wider economy due to rapid real credit growth accompanied by bubbles in real estate or equity markets, or an exchange rate actual cash appreciated.

The shift to tight monetary conditions does not appear to follow a sustained increase in financial vulnerabilities during the very loose policy period. The IPM scores suggest that 23 markets have moderate or high vulnerability to banking system stress. This is unchanged from a year ago, in part because last year’s economic recoveries reversed much of the jump in credit-to-GDP ratios caused by economic contractions during the Covid-19 pandemic.

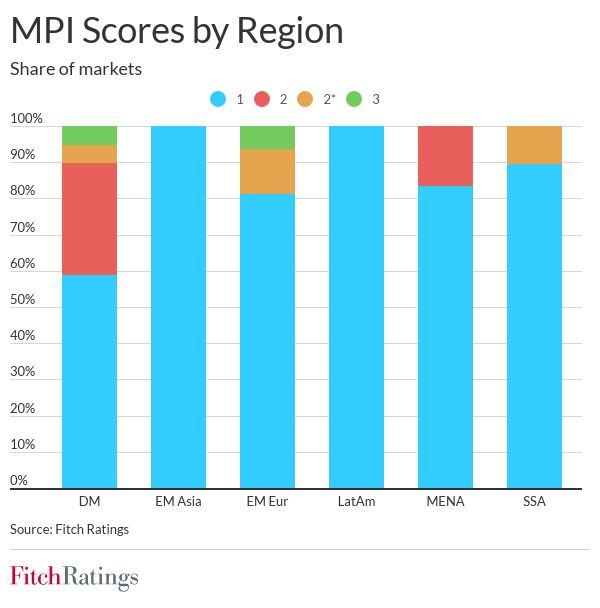

The number of markets with moderate or high vulnerability is up from 15 before the pandemic, but down from a peak of 59 in 2009, and by 20%, the proportion of high MPI scores (2, 2* and 3) is half the average. (40%) since 2005. Our latest scores point to high PMIs for 16 developed markets and only seven emerging markets, although this partly reflects methodological differences.

Japan and Turkey join Germany in recording an MPI score of 3 (high vulnerability). These are the only markets where real house price gaps triggered the MPI 3 threshold. House prices above trend have not necessarily been accompanied by an increase in leverage, which should limit the damages from possible price corrections. But the economic impact of financial vulnerabilities combined with high inflation will depend on how high interest rates rise and how asset prices and debt service burdens respond.

Source: Fitch Ratings

[ad_2]

Source link