PM images

The stock market is recovering from the lows of several weeks ago. Declining gas prices, possible grain shipments from Ukraine, improving supply chain issues and still-solid U.S. job growth have instilled investor confidence. However, the fear of recession and the Bear markets have driven stock prices lower, reducing valuations while simultaneously increasing dividend yields. So we screen and identify 5 undervalued dividend growth stocks for investors. Next, let’s talk about Best Buy Co., Inc. (ABY), Franklin Resources, Inc. (GOOD), Lincoln National Corporation (LNC), T. Rowe Price Group, Inc. (TROW), and Whirlpool Corporation (WHR) as long-term purchases.

Overview

We select nine criteria in this analysis to narrow down the list of dividend growth stocks. Our focus is the Dividend Radar Dataset, which includes stocks that increase their dividend for at least five years. The Dividend Radar is updated weekly and contains approximately 743 stocks.

The nine criteria used in our analysis are:

Payout ratio does not exceed 65%: We choose this target value as a measure of dividend safety. Dividend growth streak is at least ten years: only dividend and better candidates are included in the analysis. The dividend yield is at least 3% – our minimum target. Adjusted TTM P/E ratio is less than or equal to 18X – this value is below the S&P 500 average. YTD returns are lower (-20%) – we are looking for stocks in bear market territory. Market capitalization is at least $5 billion: We’re looking for large-cap stocks. Comply with the soup rule – For shares with a dividend yield of 3%, this value must be greater than 12%.

Additionally, we filter out distressed stocks by requiring a positive P/E ratio.

results

The results are shown in the table below, sorted by ticker. We have five matches, which are: Best Buy, Franklin Resources, Lincoln National, T. Rowe Price, and Whirlpool. Two stocks are Dividend Aristocrats and Dividend Champions, while three stocks are Dividend Contenders.

Knowledge of the portfolio

The table shows that all five stocks are clearly in bearish territory, with Best Buy and T. Rowe Price down more than 40%. Additionally, all five stocks are about 30%+ below their 52-week highs and near their 52-week lows. Additionally, all five stocks have dividend yields above 3.5% and are undervalued on a P/E basis.

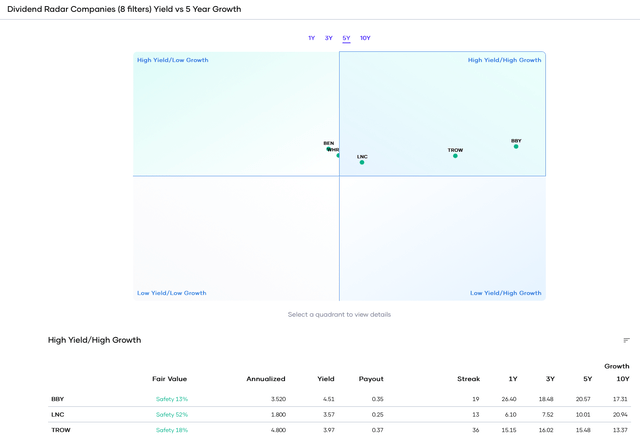

Next, we examine dividend growth versus performance for the five companies. Over the past 5 years, both T. Rowe Price and Best Buy have maintained high dividend growth rates and high yields. Lincoln National has a lower growth rate, while Franklin Resources and Whirlpool are high yielding but low dividend growth stocks. However, this point does not make them bad stocks to own. Note that the average yield point is 3% and the average growth point is 9%. Growth rates for subsequent periods are shown in the attached table.

Knowledge of the portfolio

best buy

Best Buy is a stock I’ve written positively about before. However, my previous article was too early, as the share price fell to a 52-week low in late June before recovering. In addition, the electronics retailer will likely have a difficult 2022 as consumers pull back after pandemic-fueled shopping. However, the company is still undervalued even after downward revisions to fiscal 2023 earnings estimates.

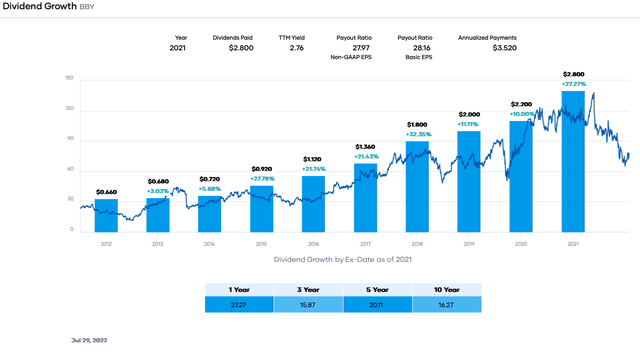

Best Buy has successfully grown revenue since 2018 and EPS since 2015, though fiscal 2022 will be a tough year. That success has fueled double-digit dividend growth for a decade. Furthermore, the dividend is well covered by earnings with a payout ratio of about 28%, leaving room for many more increases. This dividend contender with 19 years of increases should become a dividend champion.

Knowledge of the portfolio

The forward dividend yield of 4.5% is the highest in a decade. Additionally, the stock is undervalued and trades at a forward P/E ratio of ~11.2X. The company has moved to an omnichannel retail model and competes well with its larger peers. Investors should consider starting a position in Best Buy.

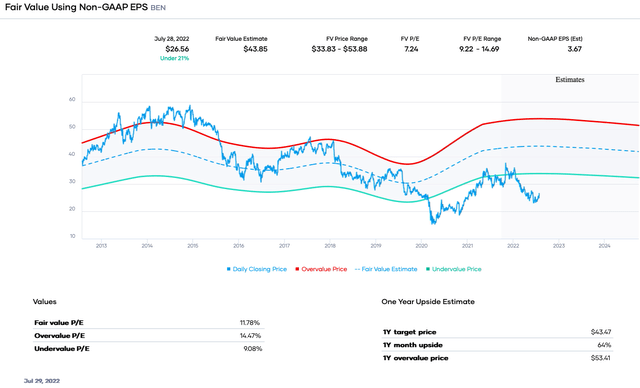

Franklin Resources

Franklin Resources is another stock I’ve written positively about. Investors love to hate this stock as it is an active mutual fund manager. Rates have been on a downward trend for two decades, hurting revenue. However, the company has bought smaller peers in a consolidating industry. The signature recently acquired Legg Masonadding to its assets under management [AUM]. Control by the founding family gives the asset manager flexibility to follow a long-term plan.

Despite lower earnings and fluctuating EPS, Franklin Resources has successfully raised its dividend for 42 years. The acquisitions combined with a low payout ratio and strong balance sheet allow the company to continue growing the dividend. The dividend growth rate has been ~8.8% over the past 5 years and ~12.8% over the past decade. The payout ratio is conservative at ~30%. Currently, there is no reason why the company cannot become a dividend king.

Investors should be interested in the roughly 4.35% dividend yield combined with the low valuation. The company’s forward P/E ratio is below the 5- and 10-year ranges. As a result, Franklin Resources is attractive now. A market recovery and increased efficiency following the Legg Mason acquisition should help boost AUM and the margins that drive earnings.

Knowledge of the portfolio

Lincoln National

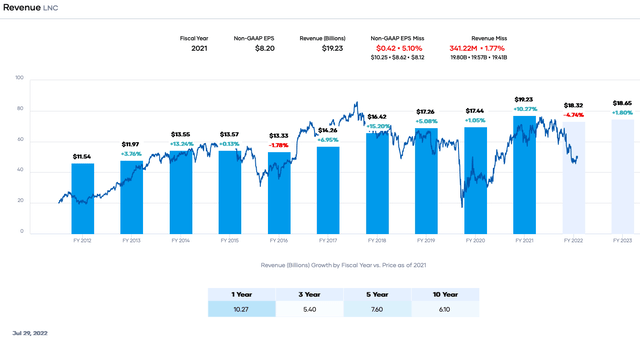

Lincoln National is an insurance and retirement plans company. It offers life insurance, annuities, mutual fund programs and group insurance. The company struggled during the pandemic with lower earnings, but rebounded quickly in 2021. That said, the stock price fell in 2022 due to the bear market and fears of a recession. Lincoln National could be hit by lower demand for its plans. However, the company has successfully grown revenue over longer periods. In turn, this has translated into profit growth, albeit inconsistently.

Knowledge of the portfolio

The fall in the share price has pushed the dividend yield to the highest value since 2020. In more than a year, the yield is the highest in a decade. The forward yield is around 3.6%, supported by a conservative payout ratio of around 20%. Lincoln National has grown its dividend at a rate of 23.7% over the trailing ten years and a slower growth rate of ~10.9% over the past five years.

The company is undervalued and trades at a forward earnings multiple of approximately 5.9X, below the 5- and 10-year median range. Despite the fears, unemployment is below 4% and job growth is robust. Investors are getting a deal with an excellent performance in the relatively little-followed company.

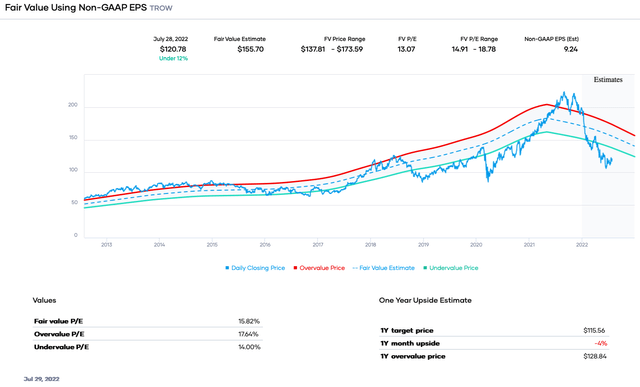

T. Rowe Price

T. Rowe Price needs little introduction for dividend growth investors. It is popular because of its sustained double-digit dividend growth rate, market leadership, net cash position on the balance sheet, and dividend aristocrat status. I’ve written positively about the stock before.

Like other asset managers, T. Rowe Price has struggled in 2022 with declining AUM driven by market action and net outflows. Investors tend to pull money out of cash or short-term bonds and stocks during bear markets. As a result, the share price has fallen and the dividend yield has increased.

There’s a lot to like here. The dividend yield is the highest in a decade at almost 4%. It was 4% higher when I first highlighted the company. Additionally, the dividend growth rate has been around 13.3% over the past decade and approximately 14.9% over the following 5 years. Low payout ratio of ~34% supports future growth. T. Rowe Price has 36 years of dividend growth.

The fall in the share price has caused the valuation to decrease significantly. However, the stock is still undervalued even after a reduction in analyst estimates for 2022. The forward P/E ratio is below the 5- and 10-year averages, but should recover – as the stock market recovers and the assets under management increase. Therefore, investors get an undervalued and proven dividend producer with excellent performance.

Knowledge of the portfolio

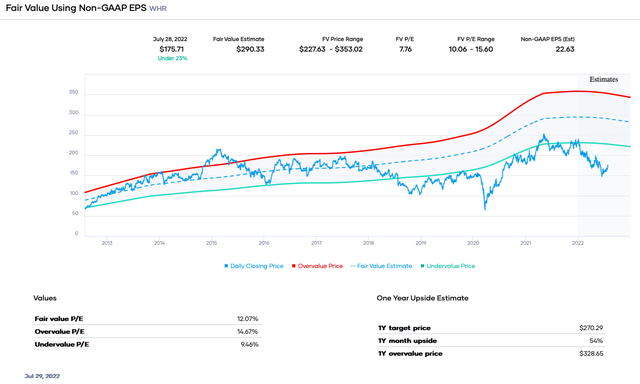

jacuzzi

Whirlpool is the last of our five undervalued dividend growth stocks. The company is known as a market leader in household appliances. Unfortunately, this year has not been kind to the company. Second-quarter results beat expectations, but inflation, supply disruptions and lower demand caused the company to cut guidance. However, the company is acting to reduce costs.

Whirlpool has been a consistent dividend growth stock with 13 years of increases, making it a dividend contender. The growth rate has been approximately 6.92% in the past five years and approximately 10.94% in the subsequent ten years. Also, the forward payout ratio is low at around 21%, which means the dividend is safe even in a recession.

The current dividend yield is the highest since the pandemic at around 4%. The fall in the share price has pushed the valuation below the 5- and 10-year average ranges, even after the cut in earnings estimates. Whirlpool should do well despite the competition. New homes and renovations should boost sales for longer periods. Investors are getting vastly undervalued stocks with excellent returns.

Knowledge of the portfolio

Final thoughts

The bear market has created undervalued opportunities for many dividend growth stocks. Investors can get stocks that are trading below their historical earnings multiples. Markets are responding to positive news and sentiment is better despite rising interest rates. I see Best Buy, Franklin Resources, Lincoln National, T. Rowe Price and Whirlpool as long-term buys.

[ad_2]

Source link