WaltStoneham/iStock via Getty Images

Stocks aren’t the only things that have risen recently. Yields and the dollar have also risen, and both may still have a lot more to go. The federal funds futures market has reversed course and now sees higher rates than where they were at the beginning of August and sees rates staying higher for longer. This message should be echoed for all to hear in the Fed minutes. After all, that has been the message from governors and board members since the July FOMC meeting.

The stock market, as usual, has been oblivious to these changes in Fed Fund futures, which Treasury yields and the dollar have properly recovered. Instead, share prices have been driven higher by short-covering CTA trends and volatility-control funds. It has been estimated that these systematic funds have been almost reallocated 28 billion dollars.

Fund flows have also helped push the VIX down a lot, but tomorrow marks a huge potential turning point. Monthly VIX due tomorrow (Wednesday) morning, followed by Fed minutes at 2pm ET. These two events don’t get much attention, but they can play a big role in driving the market for the rest of the month and potentially stalling the equity market’s recovery.

VIX

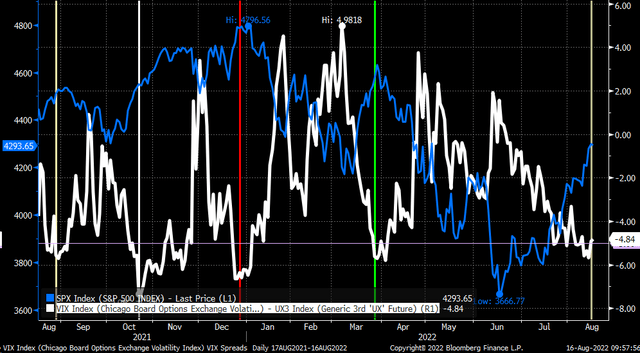

The spread between the VIX spot price and the generic 3-month VIX future, equivalent to the October contract, is around -5, which has historically coincided with the highs of the S&P 500. Recently, the spread has down to -5.7 in August. 12, indicating that the spot price of the VIX may have fallen too far and should reverse to the upside, pushing stock prices lower.

Bloomberg

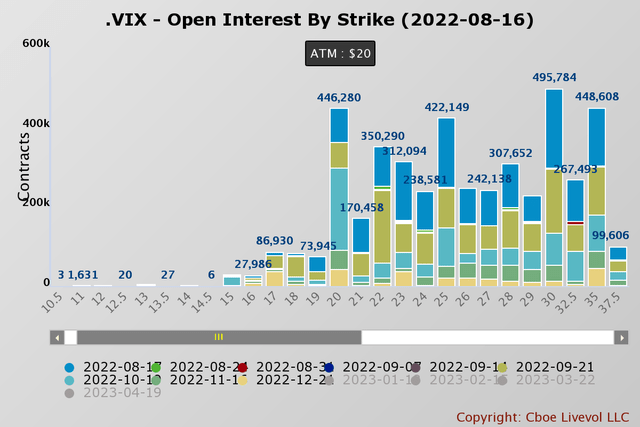

Open interest in the VIX is almost non-existent for Wednesday expiration dates and options futures. Many August call options will expire worthless tomorrow.

CBOE/TradingAlert

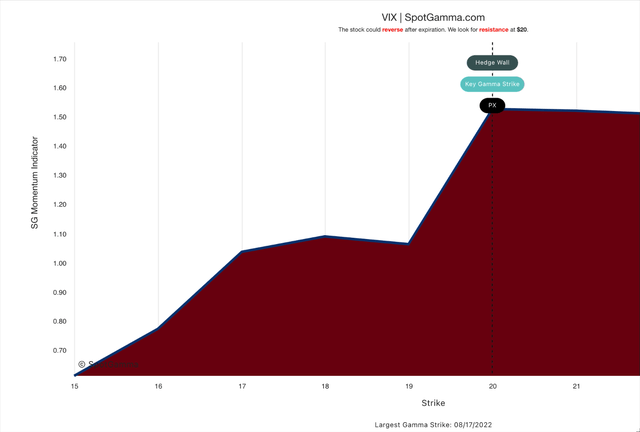

Also, SpotGamma data shows that the big gamma strike price for tomorrow’s VIX options expiration is 20, which is helping lock the VIX to 20. This also means that after tomorrow’s expiration, the VIX will be able to move more freely, and given the current spread with the VIX futures contracts, it looks more likely that the move could increase, which is bad for stocks.

SpotGamma

Minutes of the Fed

The afternoon brings another potential threat to stocks as the FOMC minutes are likely to be more bullish than the FOMC press conference was perceived to be. These minutes will likely reflect all the messages from the July press conference, but they will also reflect the tone of all the Fed governors and board members who have helped reshape the Fed Fund futures curve since the meeting in FOMC.

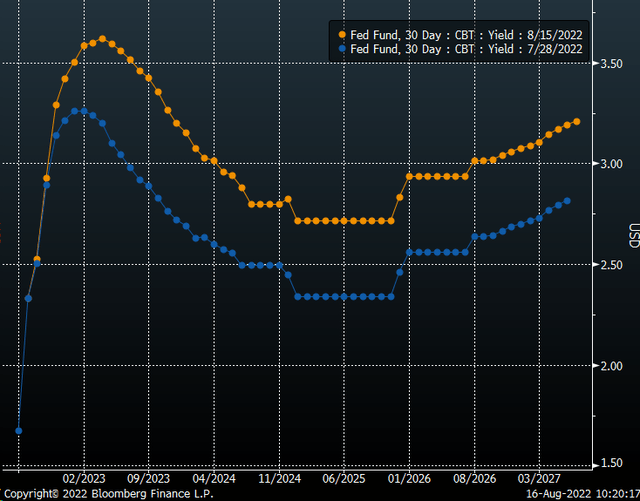

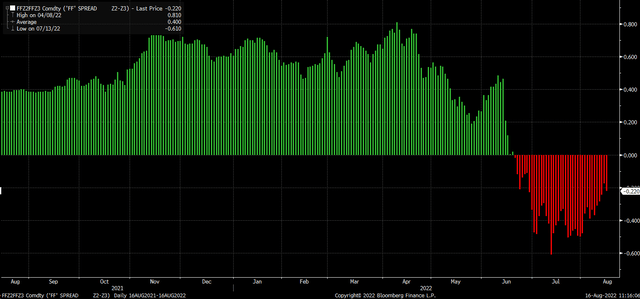

Fed Funds futures now see a peak rate in April instead of February at 3.62% versus 3.26% previously. The change in the outlook for Fed Fund Futures is beginning to reflect a more realistic message from the Fed, which is that rates are moving higher and are likely to stay there for longer than the market had previously projected.

Bloomberg

While the upward move in the futures market has already begun, much more movement will be needed, especially if the Fed stays on target with its 3.8% overnight rate message by the end of 2023 The spread between the December 2022 Fed Funds futures contract and the December 2023 contract has gone from -0.61% to -0.22%. If the Fed’s guidance is correct, the December 2023 contract must rise further.

Bloomberg

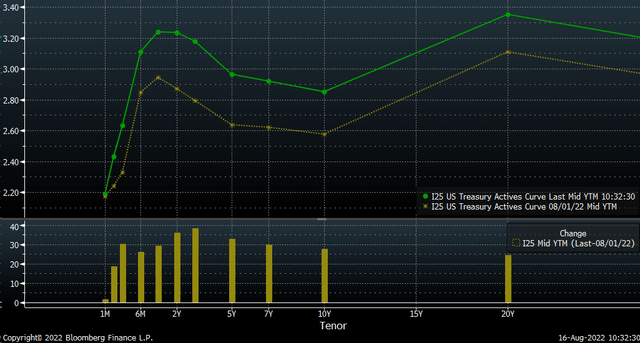

The shift in the futures market has caused rates to start rising and the dollar to strengthen. The 2-year yield has risen from its recent lows on August 1, while the 10-year and 30-year have also started to rise again, with the biggest moves at the top of the yield curve.

Bloomberg

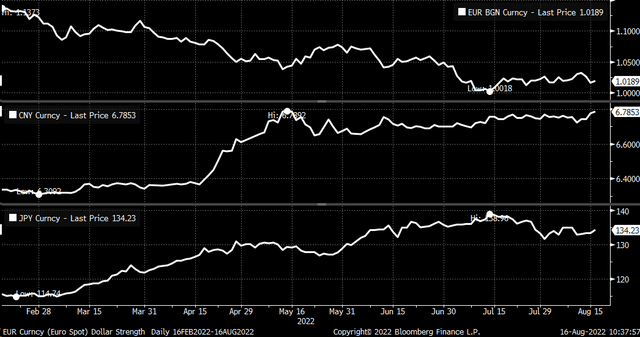

Meanwhile, this has allowed the dollar index to resume its strengthening trajectory against major currencies such as the euro, yen and yuan.

Bloomberg

The move higher in rates and the dollar since the Fed’s official talk has been significant. But a similar tone from the Fed’s minutes will help accelerate the turnaround we’ve seen so far.

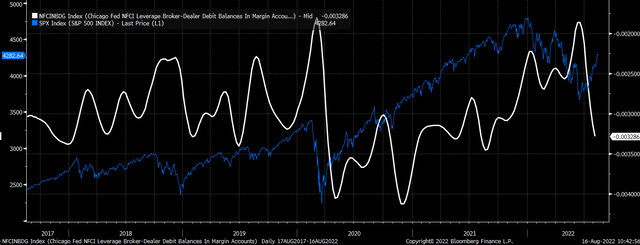

A higher move in rates and the dollar would cause credit spreads to widen, leading to a tightening of financial conditions. Financial conditions have eased sharply since the July FOMC meeting, which has also eased conditions around the ability to access margin and leverage, as measured by broker-dealer debit balances of leveraged Chicago Fed margin accounts. These easing conditions have provided a headwind for stocks, but a “reset” in financial conditions would help stall the equity market’s recovery as access to margin would be cut.

Bloomberg

Just in case: options expire

Just in case stocks decide to continue their rally, the expiration date for August stock and index options arrives on Friday, which again has historically served to mark turning points for markets. The only month that hasn’t seen a reversal of trend-following options expirations this year so far has come in March.

TradingView

So tomorrow could be a big pivot point for stocks as a scenario leading to a rising VIX, rising dollar and rising yields would put markets in a position to tighten financial conditions again and would probably stop the equity market rally in time. tracks

[ad_2]

Source link